NQ Flow Report

It all begins with an idea.

Flow Report – Friday, October 24, 2025

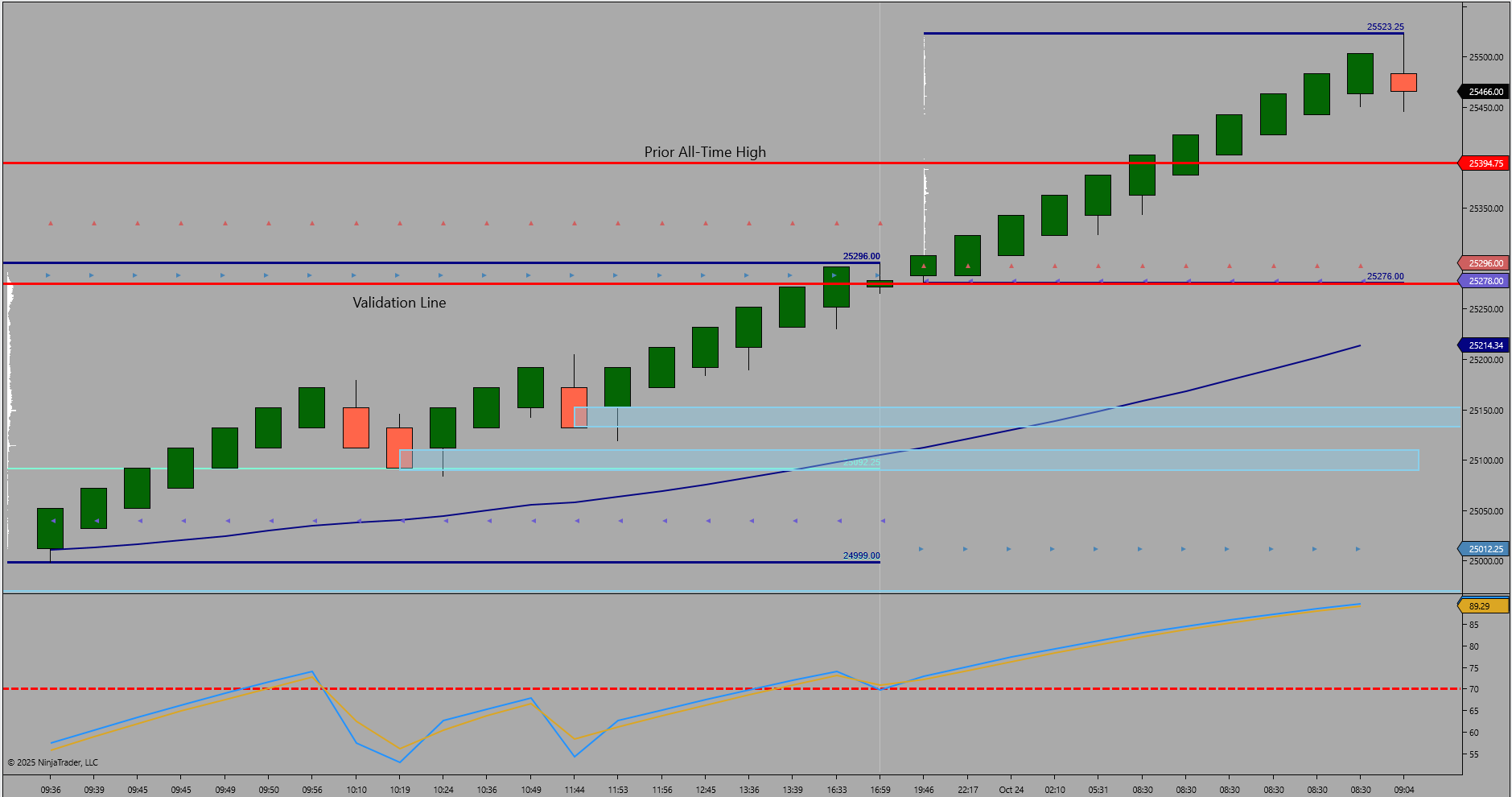

Yesterday’s RTH Recap

Thursday’s RTH session traded between 24990.00 and 25296.00. The session opened with early consolidation before building a steady upward expansion that held control through the close. Momentum confirmed continued buyer dominance, with each pullback defended and structure maintaining higher lows. The prior day’s low at 24937.00, tested during ETH, remained intact and continues to define structural demand.

Figure 1 – HTF RTH Structure Recap

Today’s ETH Framework

Overnight trade extended the upward leg, reaching a high of 25523.25 and holding a low of 25276.00. The move marked a breakout above the prior all-time high, identified by the red horizontal line on the chart. Momentum remains directional, with price consolidating just below the new record high as structure holds firmly above 25275.00. Continuation above 25500.00 opens further untested territory, while failure back below 25275.00 would suggest balance formation after the breakout.

Bias and Structure Outlook

Bias – Bullish with validation at 25275.00.

Continuation is favored while price holds above 25275.00. Sustained trade above 25500.00 confirms expansion beyond prior highs and establishes a new momentum leg. A breakdown below 25275.00 would signal rotation back into balance toward 25150.00.

Key Levels

Type: Resistance Zone

Zone Range: 25500.00 – 25523.25

Comment: ETH breakout zone and new all-time high extension

Type: Support Zone

Zone Range: 25290.00 – 25275.00

Comment: ETH structural base defining current validation level

Type: Support Zone

Zone Range: 25160.00 – 25140.00

Comment: Prior RTH defended structure

Type: Support Zone

Zone Range: 24950.00 – 24937.00

Comment: Prior day low and confirmed structural demand base

Type: Trigger Level

Zone Range: 25275.00

Comment: Validation threshold for continuation or rotation

Bias Summary

Untested HTF Structure High – 25523.25

Untested HTF Structure Low – 24937.00

Validation Level – 25275.00

Continuation favored while price holds above validation; rotation expected below.

Trader Tip

Breakouts through prior all-time highs often attract acceleration once price stabilizes above defended structure.

NQ Flow Report

It all begins with an idea.

Market Structure Update – Thursday, October 23, 2025

Morning Structure Recap

NQ opened the session with early rotation near the ETH midpoint before driving upward through 25100. A clean structural base formed between 24999.00 and 25040.00, establishing a strong defended zone that supported multiple higher-low sequences through the morning. The RTH advance extended to 25216.50, completing a full directional recovery from the ETH pullback.

Midday Structure Overview

Price action shows a well-defined rally from the defended morning base near 24999.00 toward the 25216.50 high. Multiple light-blue zones mark prior defended areas, confirming stable structure across both ETH and RTH sessions. Momentum remains constructive, with buyers maintaining control above the 25100 pocket into midday.

Current Session Rhythm

The current rhythm shows steady continuation tone, with buyers holding the 25100–25120 zone as an active control area. The 25216.50 high remains the upper expansion cap, while downside rotation remains limited so long as structure holds above the 24999.00–25040.00 base.

Key Intraday Levels

Support Zone – 24999.00 – 25040.00 – Structural base and defended ETH low

Support Zone – 25100.00 – 25120.00 – Active intraday control pocket

Resistance Zone – 25216.50 – RTH session high and expansion pivot

Trigger Level – 25100.00 – Intraday validation line; above favors continuation

Afternoon Bias

Bias – Bullish above 25100.00

Continuation is favored while structure holds above 25100.00 with potential expansion toward and through 25216.50. Rotation expected if price accepts below the control zone back into 25040.00.

Bias Summary

Untested HTF Structure High – 25344.00

Untested HTF Structure Low – 24937.00

Validation Level – 25100.00

Continuation favored above validation; rotation expected below.

Trader Tip

Momentum continuation often confirms when intraday control zones hold as defended structure. The strongest expansions build from reclaimed bases, not from fresh highs.

NQ Flow Report

It all begins with an idea.

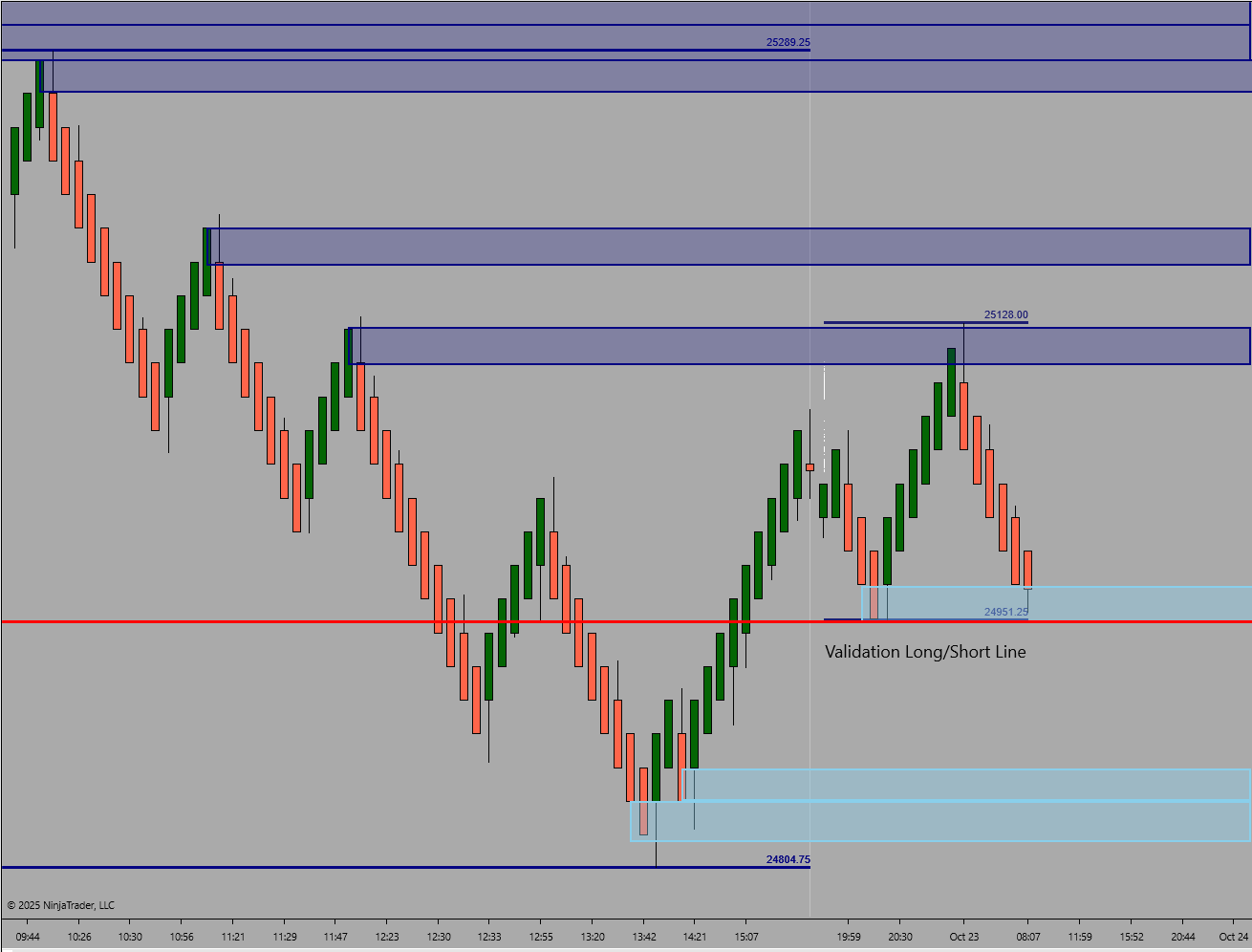

Flow Report – Thursday, October 23, 2025

Yesterday’s RTH Recap

Wednesday’s RTH session ranged between 24804.75 and 25289.25. Price advanced early, then reversed sharply from upper resistance before closing the session near mid-range. Momentum showed clear rejection from supply around 25280–25300, confirming active sellers above while buyers continued to defend structure at 24800.

October 20, 2025 RTH and ETH Chart

Today’s ETH Framework

Overnight trade developed between 25128.00 and 24951.25. The ETH session held within prior RTH balance, forming short-term compression near the mid-range zone. Price showed early rejection from the ETH high, with support structure emerging near 24950. The current structure remains balanced, awaiting direction through either 25130 for continuation or 24950 for breakdown.

Bias and Structure Outlook

Bias – Neutral with validation at 24950.00.

Continuation requires acceptance above 25130. A sustained break below 24950 opens the door to 24800. Momentum remains contained within overlapping resistance and support clusters, showing no confirmed directional control heading into the open.

Key Levels

Type: Resistance Zone

Zone Range: 25270.00 – 25290.00

Comment: RTH rejection zone and upper supply layer

Type: Resistance Zone

Zone Range: 25110.00 – 25130.00

Comment: ETH upper cap and short-term pivot

Type: Support Zone

Zone Range: 24960.00 – 24950.00

Comment: Active ETH base and lower boundary defense

Type: Support Zone

Zone Range: 24820.00 – 24800.00

Comment: RTH structural low and defended demand

Type: Trigger Level

Zone Range: 24950.00

Comment: Validation threshold for expansion

Bias Summary

Untested HTF Structure High – 25289.25

Untested HTF Structure Low – 24804.75

Validation Level – 24950.00

Continuation favored while price holds above validation; rotation expected below.

Trader Tip

Compression inside overlapping resistance and support often precedes a volatility expansion once balance resolves.

NQ Flow Report

It all begins with an idea.

NQ Midday Flow Pulse

Market Structure Update – Wednesday, October 22, 2025

Morning Structure Recap

NQ continued its overnight weakness through the morning, reaching a session low of 25003.25 before stabilizing. The session built a compression rhythm with alternating expansions and retracements, showing balanced participation. The 25160–25180 pocket emerged as the first resistance layer where sellers consistently defended intraday advances.

Figure 1 – Midday Structure Overview

Price formed repeated rotations between 25003.25 and 25177.00, maintaining defended bids near the session base while encountering supply near the 25160–25220 band. The defended low remains intact into midday, confirming structural stability but limited follow-through momentum.

Current Session Rhythm

The market remains in rotation beneath high-timeframe resistance at 25273.00–25289.25. Buyers continue to defend 25003.25, which anchors the current structural base. The control line at 25106.50 defines the pivot between continuation and rotation, with responsive momentum surrounding this zone through midday.

Key Intraday Levels

Support Zone – 25003.25 – 25040.00 – Active defended base and ETH structural low

Resistance Zone – 25177.00 – 25220.00 – Intraday supply and compression ceiling

High-Timeframe Resistance – 25273.00 – 25289.25 – Overhead structure cap

Trigger Level – 25106.50 – Midday control line; above favors squeeze toward 25177.00

Afternoon Bias

Bias – Neutral to Bullish above 25106.50

Continuation is favored while structure holds above 25106.50 with potential expansion toward 25177.00–25220.00. Acceptance below this level would reintroduce rotation back toward the 25040.00–25003.25 base.

Bias Summary

Untested HTF Structure High – 25289.25

Untested HTF Structure Low – 25003.25

Validation Level – 25106.50

Continuation is favored above validation; rotation expected below.

Trader Tip

Momentum through defended lows often builds the next directional leg. Sustained bids at structure support define where reversal conviction begins.

NQ Flow Report

It all begins with an idea.

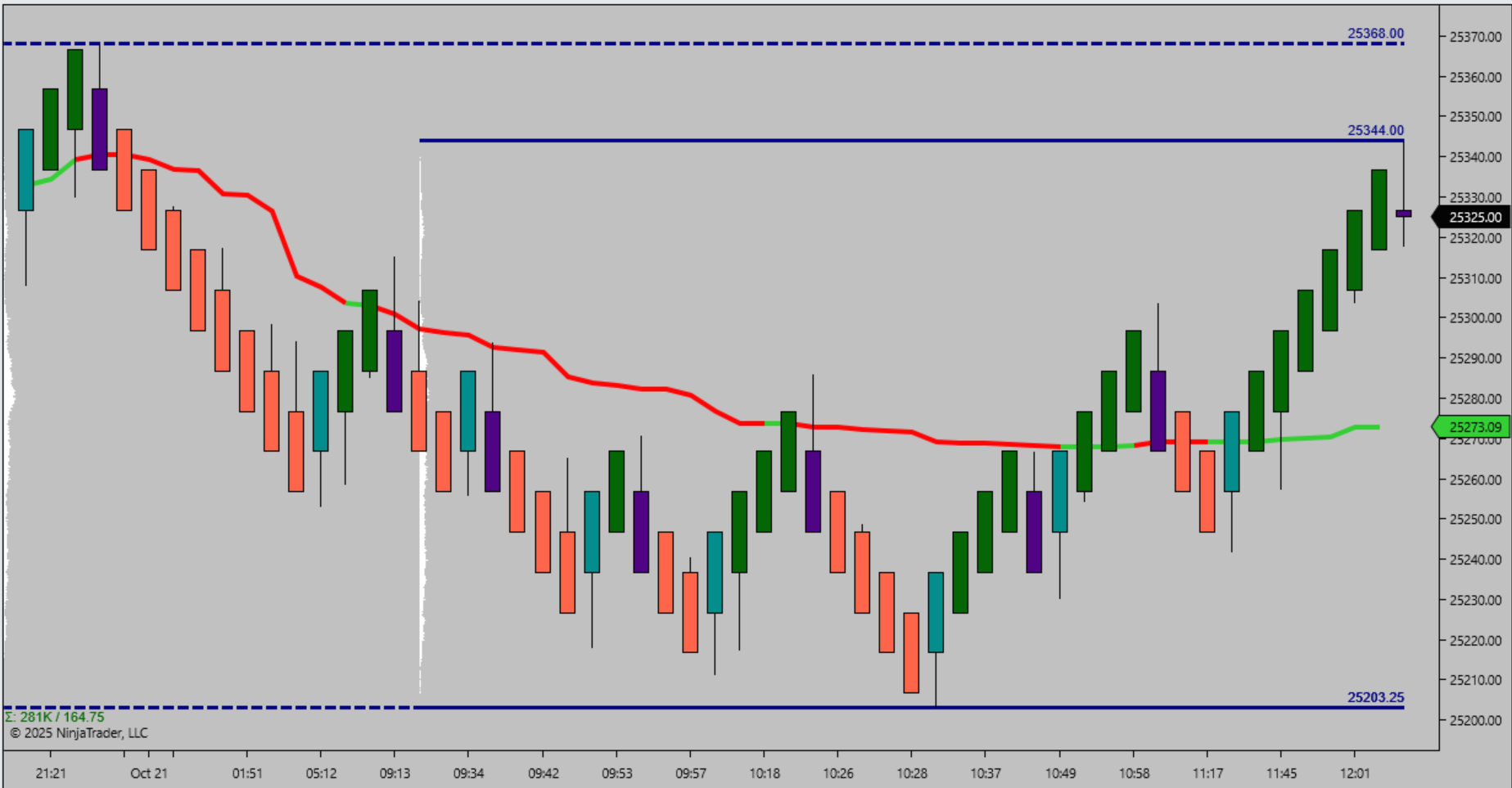

Flow Report – Wednesday, October 22, 2025

Yesterday’s RTH Recap

Tuesday’s RTH session ranged between 25368.50 and 25203.25, holding a narrow two-sided rotation through midday before sellers gained control into the close. The session built layered resistance near 25340–25360, while responsive buyers defended structure at 25200–25230. Momentum compressed inside the upper half of the prior range, setting up a potential directional break.

HTF RTH Structure Recap

Today’s ETH Framework

Overnight price action remained confined between 25338.25 and 25200.50, tracking closely to yesterday’s RTH range. An early-session test around 07:40 a.m. ET rejected from yesterday’s low, confirming buyer defense within the active support base. Momentum remains balanced, with continuation potential only upon acceptance above 25340.00 or failure below 25200.00.

HTF ETH Framework Preview

Bias and Structure Outlook

Bias – Neutral with validation at 25200.00.

Continuation requires decisive expansion beyond either boundary: a break above 25340.00 favors bullish control, while sustained trade below 25200.00 opens lower balance targets near prior untested demand. Structure is currently contained within overlapping resistance and defended support, suggesting compression ahead of the U.S. session.

Key Levels

Type: Resistance Zone

Zone Range: 25338.25 – 25368.50

Comment: Overlapping upper supply and ETH high cluster

Type: Resistance Zone

Zone Range: 25300.00 – 25320.00

Comment: Secondary intraday cap formed during RTH

Type: Support Zone

Zone Range: 25230.00 – 25200.50

Comment: Active ETH base with early-session rejection

Type: Support Zone

Zone Range: 25206.25 – 25203.25

Comment: Structural RTH low and defended demand

Type: Trigger Level

Zone Range: 25200.00

Comment: Validation threshold for directional expansion

Bias Summary

Untested HTF Structure High – 25368.00

Untested HTF Structure Lows – 25203.25 / 25045.25 / 24955.75

Validation Level – 25200.00

Continuation favored while price holds above validation; rotation expected below.

Trader Tip

Rejection from prior session lows within active support often signals early-session absorption before directional confirmation.

NQ Flow Report

It all begins with an idea.

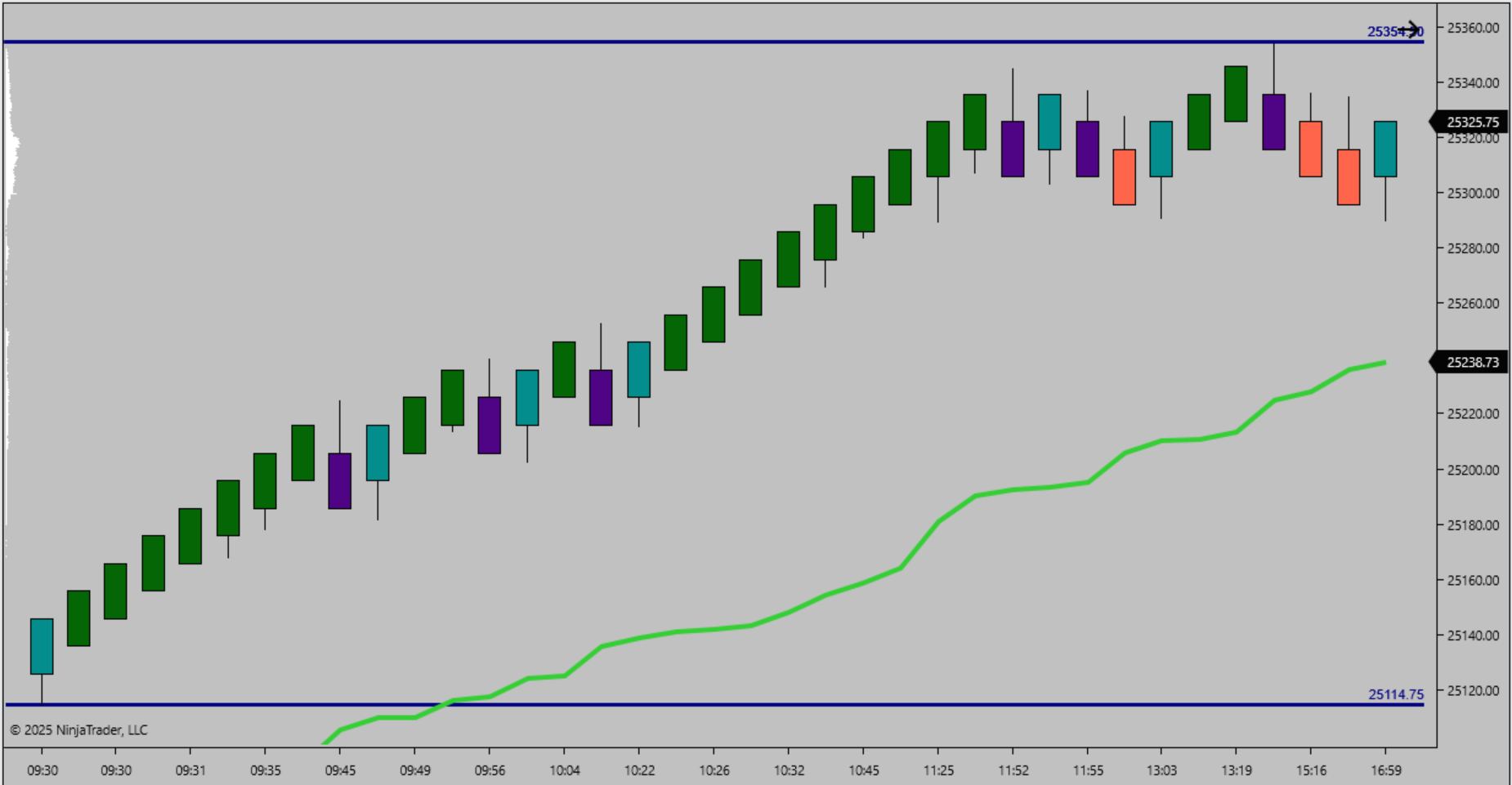

NQ Midday Flow Pulse

Market Structure Update – Monday, October 20, 2025

Morning Structure Recap

NQ opened the RTH session near 25203.25 and rotated lower before establishing a firm base. From that foundation, price expanded upward through a series of higher-highs toward 25344.00, completing a full-range directional recovery into midday. The climb developed steadily, with each pullback defended above the developing control line, confirming regained momentum alignment as the session transitioned toward ETH open.

Figure 1 - Chart Midday Structure Overview (October 22, 2025)

The chart highlights a complete intraday rotation from the RTH low 25203.25 to 25344.00. Price shows clear higher-low rhythm through the late morning climb, with 25273.00 marking the structural control line and 25203.25 defining the defended base. Momentum maintained elevation into the ETH open, signaling sustained structural strength.

Current Session Rhythm

Midday rhythm shows continuation strength as price stabilizes near the ETH open above 25273.00. The defended RTH base at 25203.25 anchors the structure, while resistance remains defined at 25344.00. Momentum rhythm favors continuation while holding above the control line.

Key Intraday Levels

Support Zone – 25203.25 – 25230.00 – RTH low and structural base

Resistance Zone – 25344.00 – RTH morning high and exhaustion pivot

Trigger Level – 25273.00 – Active control line; above favors continuation

Afternoon Bias

Bias – Bullish above 25273.00

Continuation remains favored while structure holds above 25273.00. Acceptance below this level would signal a return rotation toward the base near 25203.25.

Bias Summary

Untested HTF Structure High – 25432.75

Untested HTF Structure Low – 24955.75

Validation Level – 25273.00

Continuation is favored when price holds above validation and rotation expected below.

Trader Tip

Structure expands through the same levels it first defends. Momentum confirms continuation when rhythm sustains above the breakout base.

NQ Flow Report

It all begins with an idea.

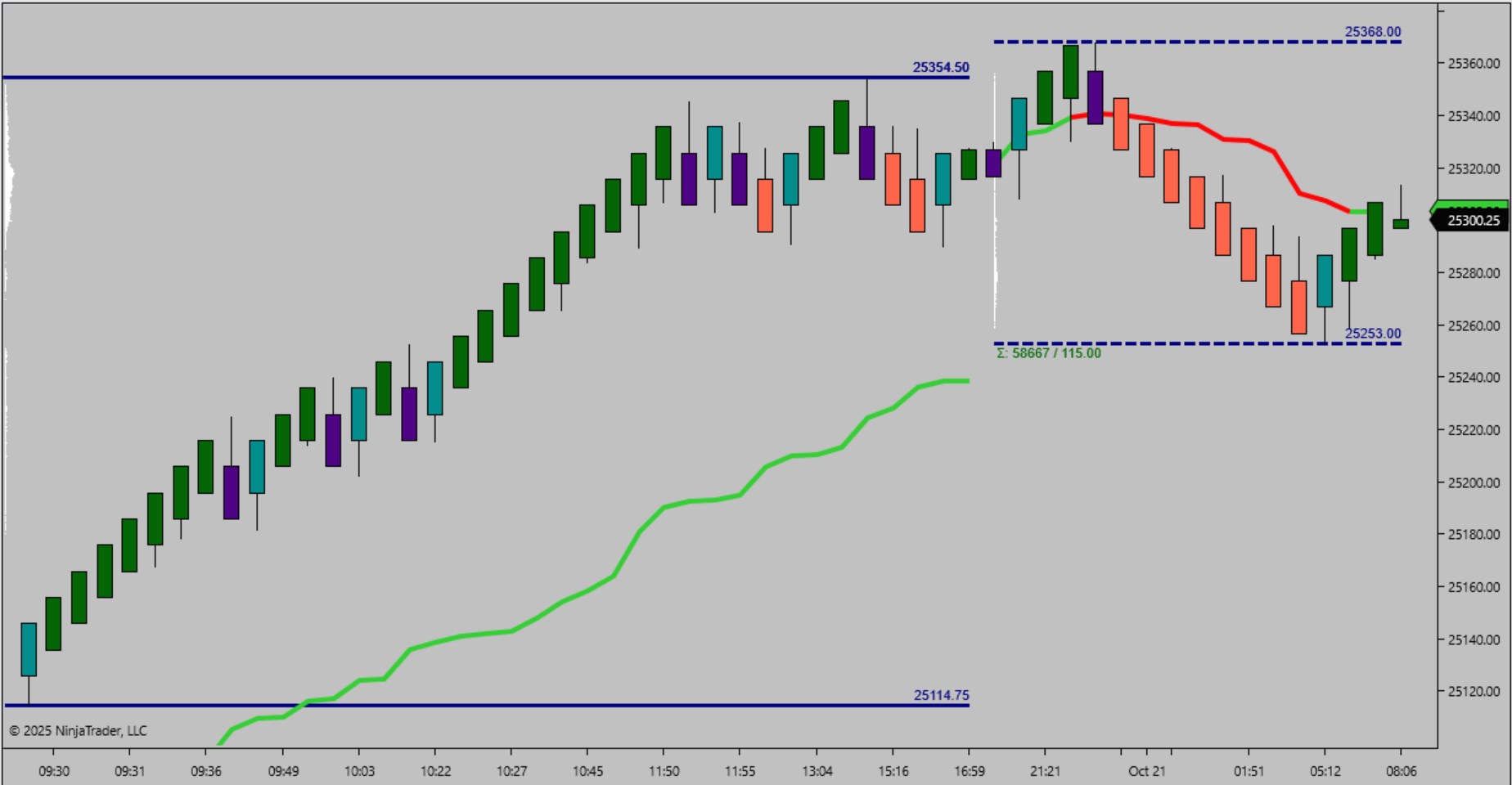

Flow Report – Tuesday, October 21, 2025

Yesterday’s RTH Recap

Monday’s RTH session extended the bullish sequence from 25114.75 to 25354.50. Structure advanced cleanly with higher highs and shallow pullbacks, confirming momentum continuation through the prior ETH high. Price compressed near the upper boundary into the afternoon, limiting trade entry opportunity as control remained firmly one-sided.

RTH Session October 20, 2025

Today’s ETH Framework

Overnight trade extended slightly beyond Monday’s high, printing 25368.00 and maintaining a narrow consolidation above 25253.00. The session shows steady balance within elevated structure, suggesting early continuation potential while holding above prior RTH support. With no scheduled economic catalysts today, price rhythm and momentum sequence will define the open.

ETH Session October 21, 2025

Bias and Structure Outlook

Bias – Bullish with validation at 25253.00.

Continuation remains favored while structure holds above 25253.00. Sustained trade above 25350.00 confirms active momentum control. A breakdown below 25250.00 could rotate price toward 25150.00 to retest lower balance.

Key Levels Table

Support Zone 25253.00 ETH base and validation level

Resistance Zone 25368.00

Overnight high and expansion marker Trigger Level 25350.00

Momentum continuation threshold

Bias Summary

Untested HTF Structure High – 25368.00

Untested HTF Structure Lows – 25045.25, 24955.75

Validation Level – 25253.00

Continuation is favored while price holds above validation; rotation expected if momentum fades below.

Trader Tip

Compression near expansion highs often limits trade opportunity but confirms sustained structural control.

NQ Flow Report

It all begins with an idea.

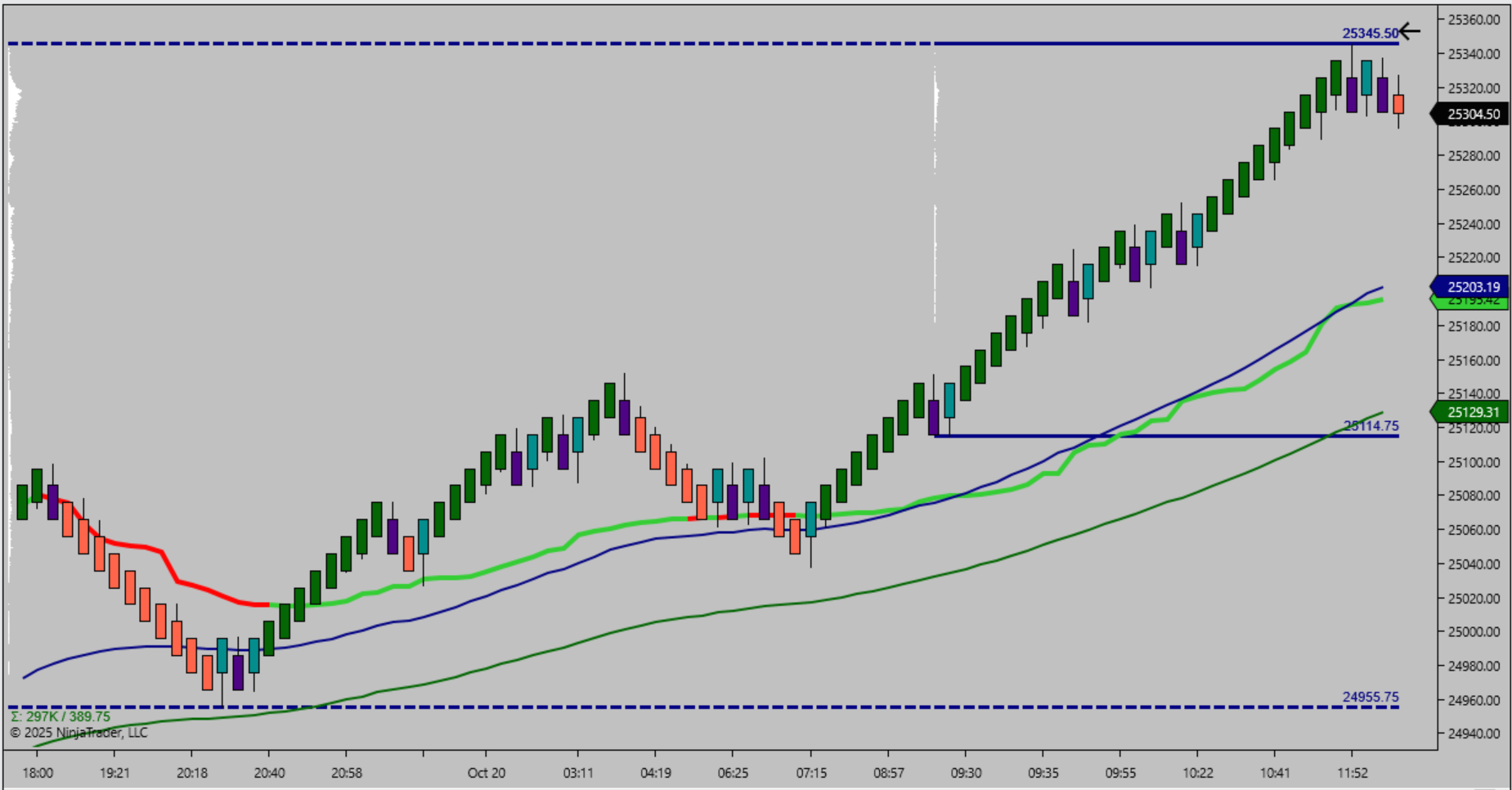

NQ Midday Flow Pulse

Market Structure Update – Monday, October 20, 2025

Morning Structure Recap

NQ extended sharply from the early ETH base near 24955.75, driving a one-sided morning expansion to 25345.50. Structure remained directional with clean higher highs and shallow pullbacks, showing firm momentum control through the morning rotation window.

Figure 1 – 80-Chart Midday Structure Overview (ETH/RTH, October 20, 2025)

Current Session Rhythm

Midday rhythm shows initial exhaustion near the 25345.50 high, with price stabilizing above 25200–25130. The prior breakout zone around 25114.75–25129.31 now defines the intraday structural base. The tone remains bullish while the session holds above this pocket.

Key Intraday Levels

TypeLevelCommentSupport Zone25114.75 – 25129.31Prior breakout and structural baseResistance Zone25345.50Morning high and exhaustion pivotTrigger Level25203.19Midday control line; above favors continuation

Afternoon Bias

Bias – Bullish while above 25203.19.

Continuation remains favored with rhythm holding above the trigger zone; acceptance below 25200 would shift tone toward rotation.

Bias Summary

Untested HTF Structure High – 25345.50

Untested HTF Structure Low – 24955.75

Validation Level – 25203.19

Continuation is favored when price holds above validation and rotation expected below.

Trader Tip

Structure expands through the same levels it first defends. Momentum often confirms when prior breakout zones hold as midday support.

NQ Flow Report

It all begins with an idea.

Flow Report – Monday, October 20, 2025

Yesterday’s RTH Recap

Friday’s RTH session advanced from 24672.50 to 25055.75, establishing a strong directional leg before consolidating near the highs into the close. Momentum favored buyers throughout the session, confirming a shift from last week’s corrective structure toward higher balance.

Figure 1 – HTF RTH Structure Recap

Today’s ETH Framework

Overnight action extended the RTH strength, printing a high of 25152.50 and holding structure above 24955.75. The ETH session maintained higher lows, showing steady momentum through the upper balance region. No economic catalysts are scheduled today, allowing structure-driven rhythm to define the early session tone.

Figure 2 – HTF ETH Framework Preview

Bias and Structure Outlook

Bias – Bullish with validation at 24955.75.

Continuation is favored while holding above 24955.75. A rotation below 24950 could invite a test toward 24832.50. Holding momentum through 25100 keeps buyers in control for potential expansion toward 25200.

Key Levels Table

TypeLevelCommentSupport Zone24955.75ETH defended structure and RTH carried lowResistance Zone25152.50Overnight high, potential expansion targetTrigger Level24955.75Bias validation and continuation threshold

Bias Summary

Untested HTF Structure High – 25152.50

Untested HTF Structure Lows – 24955.75, 24832.50, 24762.50

Validation Level – 24955.75

Continuation is favored while price holds above validation; rotation expected if momentum weakens below.

Trader Tip

Momentum continuation through untested structure confirms trend rhythm without external catalysts.

NQ Flow Report

It all begins with an idea.

Weekly Market Recap (October 13–17, 2025)

Market Overview

Nasdaq futures traded within a steady rotational range throughout the week, forming a balanced-to-bullish continuation structure. Early weakness to 24410.00 was met with responsive buying midweek, leading to a controlled recovery into the upper range by Friday’s close. Momentum held firm above the long-term trend line, confirming the market’s constructive tone.

Key Levels and Structure Points

Weekly High: 25179.50

Weekly Low: 24410.00

Untested High Timeframe Low: 24410.00

Bias: Balanced-to-bullish continuation above long-term trend

Momentum: Moderate tempo with responsive buyers defending midweek lows

The week’s structure developed a clear two-sided range between 24410.00 and 25179.50. Buyers absorbed pressure near the lower boundary and sustained momentum higher through late-week sessions. Each retracement was shallow, indicating steady conviction from long-side participants.

Momentum and Participation

Participation remained stable, with rhythmical rotations defining the session tempo. Responsive buying supported each controlled pullback, while sellers failed to extend past key midrange zones. The pace reflected healthy, deliberate engagement as price worked toward the upper end of the range.

Takeaway of the Week

The week ended with price strength near the upper range, maintaining bullish control heading into the upcoming sessions. Continued acceptance above 24750.00 would reinforce a continuation bias, while rejection under that level could lead to a retest of 24410.00 support.

Next Week’s High-Impact Economic Events

Tuesday 10:00 – Existing Home Sales (Sep)

Thursday 08:30 – Inflation Rate MoM (Sep)

Thursday 08:30 – Inflation Rate YoY (Sep)

Thursday 08:30 – Core Inflation Rate MoM (Sep)

Thursday 08:30 – Core Inflation Rate YoY (Sep)

NQ Flow Report

It all begins with an idea.

Pre-Market Report – October 17 2025

Market Overview

Nasdaq futures are trading higher into the U.S. session following a strong overnight recovery from early weakness.

Price reached an ETH high of 24858.50 and held above 24700.00 heading into the morning session, signaling renewed buyer control.

The rebound developed after price found support near the ETH low of 24410.00, establishing a clear lower boundary within a broad range structure.

Momentum remains constructive above 24650.00, with continuation potential if structure can sustain above the short-term moving averages.

Key Levels & Structure

ETH High (Resistance): 24858.50

ETH Low (Support): 24410.00

Untested High-Timeframe References:

Low – 24493.50 High – 24835.50

Intermediate Support Zone: 24630.00 – 24700.00

A confirmed breakout above 24860.00 would open the door toward 25000.00, while rejection below 24630.00 would favor renewed balance development.

Volatility & Timing

Volatility during the overnight session was elevated early, followed by steady compression as structure transitioned into the U.S. pre-market range.

The market is entering the day balanced but with a bullish tone, as volume consolidates near the upper third of the ETH session.

With no scheduled high-impact economic events, structure and flow are expected to guide directional development.

Takeaway into the Session

The market begins Friday with upward momentum and clear range definition between 24410.00 and 24860.00.

Holding above 24700.00 favors continuation, while loss of that level would shift the near-term outlook back to neutral.

Buyers will look for acceptance above 24835.50 to confirm continuation strength into the end of the week.

Today’s High-Impact Economic Events

None scheduled.

NQ Flow Report

It all begins with an idea.

Post-Market Report – October 17, 2025

Market Recap

Nasdaq futures traded in a wide two-sided range Friday, opening near the midpoint of Thursday’s structure before extending both directions through the session.

Price reached a high of 25179.50 early in the morning before rotating sharply lower to test 24643.50, completing a full expansion cycle between the established extremes.

By the afternoon, the market stabilized just above 24850 as participants balanced positions ahead of the weekend.

Key Levels & Reactions

Strong resistance formed at 25179.50, creating a clear upper boundary for the session.

Responsive buyers absorbed pressure near 24643.50, defending the lower extreme and restoring short-term balance.

Untested high-timeframe reference levels remain active at 24695.50 (low) and 24957.00 (high), marking the next zones of structural importance for early next week.

Rotation between these levels defines a balanced control zone, suggesting continued two-way participation within the broader continuation framework.

Volatility & Timing

Volatility remained elevated throughout the day, with early expansion and mid-session reversal producing clean structural rhythm.

The midday compression phase reflected exhaustion from both sides following the wide morning move.

Tempo slowed into the close, consistent with profit-taking behavior and controlled end-of-week positioning.

Takeaway of the Day

Friday’s session completed a textbook expansion and reversion cycle, confirming efficient structure rotation across all active timeframes.

Holding above 24695.50 will support renewed continuation attempts early next week, while sustained trade below that level would suggestdeeper balance development.The 24950–25000 region remains a critical pivot for directional confirmation.

Tomorrow’s High-Impact Economic Events

None

NQ Flow Report

It all begins with an idea.

Pre-Market Report – October 16, 2025

Market Overview

Nasdaq futures extended higher overnight before consolidating near 25 070 following the 08:30 U.S. data releases.

Price reached a session high of 25 099.50 after Wednesday’s close and continues to trade just below that level in early U.S. hours.

The broader structure remains bullish above 24 980 as momentum aligns with the prior day’s recovery from 24 663 support.

Immediate focus is whether buyers can sustain control above 25 000 to maintain continuation strength.

Key Levels & Structure

ETH High (Resistance): 25 099.50

ETH Low (Support): 24 874.75

Untested High-Timeframe Low: 24 852.75

Intermediate Support Zone: 24 930 – 24 980

Acceptance above 25 100 opens room toward 25 115 and potential extension to 25 200, while failure to hold 24 930 would suggest rotation back toward 24 850.

Volatility & Timing

Volatility expanded briefly post-data as the market reacted to U.S. Producer Price and Retail Sales releases.

The initial response showed a brief pullback that was quickly absorbed by buyers, signaling continued upside momentum.

Intraday tempo is expected to normalize into mid-morning with rotational behavior likely between 24 980 and 25 100 until clear directional acceptance is formed.

Takeaway into the Session

Market bias remains constructive above 24 980 with bullish continuation potential if buyers hold the upper zone.

A break and acceptance below 24 930 would mark a shift back to short-term balance or rotation.

Until then, structure favors controlled continuation toward the 25 115 reference from Wednesday’s high.

Today’s High-Impact Economic Events

None

NQ Flow Report

It all begins with an idea.

Post-Market Report – October 15, 2025

Market Recap

Nasdaq futures traded in a wide two-sided range Wednesday, marked by strong early volatility and a retrace to VWAP at the end of the session.

Price opened with momentum extension toward a high of 25,115.00 before reversing sharply to test 24,663.25.

After midday stabilization, buyers regained balance near 24,900 as structure rotated around VWAP into the close.

The session reflected broad participation and controlled structure rotation consistent across higher timeframes.

Key Levels & Reactions

Initial upside strength met firm resistance near 25,115.00, forming a clean daily high.

Responsive buyers defended structure at 24,663.25, establishing a reliable intraday low.

An untested high-timeframe price remains active at 24,852.75, providing an important reference if structure revisits the lower zone.

Intermediate value developed between 24,850–24,950, confirming two-sided balance through the afternoon session.

Volatility & Timing

Volatility remained elevated throughout the day, highlighted by a sharp intraday reversal and steady range rotation around VWAP.

Momentum slowed in the final hour, suggesting exhaustion from both sides after a full expansion cycle.

Despite the wide swings, structural alignment remained intact across all timeframes.

Takeaway of the Day

Wednesday’s session displayed efficient two-way trade and rotational equilibrium.

Holding above the untested low at 24,852.75 will confirm continued structural strength into Thursday.

Failure to hold could reopen trade toward 24,660, while sustained acceptance above 24,950 may invite renewed continuation.

Today’s High-Impact Economic Events

08:30 – PPI MoM (Sep)

08:30 – Retail Sales MoM (Sep)

NQ Flow Report

It all begins with an idea.

Pre-Market Report – October 15, 2025

Market Overview

Nasdaq futures are trading firmly higher in the overnight session, revisiting the prior ETH high from October 14 near 25 025.50.

Momentum has extended in a controlled advance from the 24 740 support base, showing clear alignment across higher-timeframe structure.

Buyers remain in control while price consolidates beneath resistance, with responsive sellers beginning to appear near the upper boundary.

Key Levels & Structure

ETH High (Resistance): 25 025.50

ETH Low (Support): 24 740.50

Intermediate Support Zones: 24 866 – 24 897

Holding above 24 866 keeps directional confidence intact, while a sustained break below 24 740 would indicate short-term exhaustion and rotation risk.

Volatility & Timing

Volatility has expanded slightly versus Tuesday’s balanced session, reflecting increased momentum carryover into early U.S. hours.

The opening sequence will hinge on whether buyers can hold above 24 900 during the first 30 minutes of RTH.

A clean continuation through 25 025 could open a momentum leg toward the next upside reference near 25 100.

Takeaway into the Session

Market structure remains constructive and favoring continuation while above 24 866.

Short-term focus is on rotation and absorption near 25 025 to 25 050.

A breakout with acceptance above the ETH high would confirm sustained bullish control, while a rejection could trigger a controlled pullback into 24 740 support.

Today’s High-Impact Economic Events

None scheduled..

NQ Flow Report

It all begins with an idea.

Post-Market Report – October 14, 2025

Market Recap

Nasdaq futures advanced early Tuesday, recovering from the previous session’s lower range before consolidating into a controlled afternoon balance.

Price opened near 24,500, trended higher toward 24,947.50, and closed the session within midrange equilibrium around 24,770.

Throughout the day, structure remained orderly with responsive activity defining both intraday extremes.

Key Levels & Reactions

Buyers defended support at 24,421, maintaining structure above prior lows.

Resistance held firm near 24,947.50, where repeated rotations showed exhaustion in upward momentum.

Within this developing range, several untested high-timeframe prices remain active:

Lows: 24,674.00, 24,692.50, and 24,714.00

High: 24,934.25

These levels will serve as key reference points for future continuation or rotation.

Near-term balance remains centered between 24,740–24,770, where control transitioned between buyers and sellers late in the session.

Volatility & Timing

Volatility moderated after the morning expansion, with consistent rhythm across timeframes.

Midday rotations reflected disciplined control and clear order-flow balance, while late-day tempo slowed into stable compression ahead of Wednesday’s open.

The session maintained clean structure without signs of disorderly activity or acceleration.

Takeaway of the Day

Tuesday’s trade reinforced a constructive mid-range balance within the broader upward structure.

The market continues to build a base above 24,400 with untested levels above and below offering clear directional markers.

Continuation strength above 24,947.50 could reopen a path toward 24,934.25, while sustained weakness below 24,740 could rotate toward the 24,670s zone of untested support.

Today’s High-Impact Economic Events

None.

NQ Flow Report

It all begins with an idea.

October 15, 2025

Market Recap

Overnight trade continued to show controlled pressure inside the broader lower distribution that developed earlier in the week.

The ETH session extended its decline from the 25,044.25 high and stabilized near 24,502.50, forming a defined lower balance area.

Price action remained orderly as responsive buying emerged into the early morning hours, signaling measured interest near the structural low.

Key Levels & Reactions

The ETH high at 25,044.25 marks the upper boundary of near-term resistance.

The ETH low at 24,502.50 defines the lower edge of current structure and remains the key level for continuation buyers to defend.

A recovery toward 24,723–24,730 may test alignment against short-term moving averages, while sustained trade below 24,500 would confirm continued downside momentum.

Volatility & Timing

Overnight volatility was moderate with consistent rhythm and clean rotations within the established balance zone.

Tempo remained controlled, with responsive activity defining both edges of structure.

The early U.S. session will likely hinge on directional expansion outside the ETH range as liquidity builds into morning participation.

Takeaway of the Session

The ETH session reinforced a well-defined lower range between 25,044.25 and 24,502.50.

Continuation strength will depend on reclaiming structure above 24,730, while further weakness below 24,500 could extend the lower auction.

Traders should maintain focus on clean structure and measured rhythm during early U.S. development.

Today’s High-Impact Economic Event

12:20 – Fed Chair Powell Speech (U.S.)

NQ Flow Report

It all begins with an idea.

Post Market Report - October 14, 2025

Market Recap

Nasdaq futures traded in a controlled range Tuesday as participants maintained a neutral posture through most of the session.

Price opened near 24,820 and rotated between 24,720 support and 24,965 resistance, forming a balanced intraday structure.

Buyers and sellers showed disciplined control, keeping price contained within a narrow zone of equilibrium.

Key Levels & Reactions

Support developed again around 24,724, where early weakness was met with steady responsive buying.

Resistance held near 24,965, capping multiple attempts at extension.

This well-defined two-sided structure marked the day as rotational, showing that market participants remain balanced while awaiting new directional triggers.

Continuation strength would require acceptance above 24,965, while a sustained break under 24,720 could open room toward 24,500.

Volatility & Timing

Volatility remained moderate throughout the session.

The morning produced steady two-way participation with clean rhythm between rotations.

As the day progressed, tempo slowed slightly and structure tightened, consistent with late-session balance behavior.

The overall pace reflected controlled participation and clear technical alignment.

Takeaway of the Day

Tuesday reinforced a stable, range-bound structure with no clear directional bias.

Both sides defended their levels effectively, keeping the market in balance above 24,720.

If momentum expands, structure above 24,965 will determine whether continuation strength emerges later in the week.

Today’s High-Impact Economic Event

12:20 – Fed Chair Powell Speech (U.S.)

NQ Flow Report

It all begins with an idea.

IFC’s Structured Framework for Continuation Trading

Market Concept Overview

IronFlow Capital (IFC) applies a structured framework that focuses on understanding how market structure develops and how continuation trades evolve within it.

Continuation trades represent moments when price confirms directional control — where a prior move extends rather than reverses. By studying price action and structure, IFC emphasizes identifying the underlying balance between momentum and exhaustion.

This framework relies on observation of how price interacts with key areas of support and resistance rather than predicting reversals. The focus remains on reading the behavior of the market as it builds and sustains directional intent.

Key Levels & Reactions

Continuation trading begins with recognizing structure: higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend.

Each pullback or pause provides new information about market participation. When price holds structure and resumes movement in the direction of the prior impulse, that movement reflects continuation behavior.

This approach allows IFC to align with prevailing order flow and avoid trading against confirmed structure.

Volatility & Timing

Market tempo plays a critical role in identifying continuation conditions.

Periods of rising participation and consistent rhythm often precede extensions of the existing move, while erratic or low-volume conditions increase the likelihood of rotation.

RSI, when referenced, is used only as a general visual filter to assess whether momentum aligns with structure — not as a signal by itself.

Takeaway of the Day

The IFC framework focuses on structured observation and disciplined participation. By reading price behavior within market structure, traders can identify opportunities that confirm direction rather than anticipate reversals.

Continuation trades reveal where confidence returns to the market and where structure remains intact.

NQ Flow Report

It all begins with an idea.

Pre-Market Outlook: October 13, 2025

Market Recap

Nasdaq futures recovered moderately through the Sunday evening and Monday early morning ETH session after last week’s sharp decline. The overnight range established initial balance between 24,542 and 24,945, showing early signs of responsive buying interest. Despite the recovery, overall momentum remains neutral to corrective as the market consolidates below Friday’s breakdown zone.

Key Levels & Reactions

Overnight trade built value above 24,600 with repeated tests toward 24,900 failing to expand higher. The 24,542 zone now marks key ETH session support, while 24,945 defines the upper boundary of overnight resistance.

Holding above 24,700 into the RTH open would favor a short-term attempt to retrace Friday’s imbalance toward 25,000. Conversely, acceptance below 24,540 would suggest sellers are reasserting control, opening potential continuation toward 24,200.

Volatility & Timing

Volatility remained contained through most of the ETH session, though tempo increased near the London open as buyers defended mid-range structure.

Heading into the U.S. session, early volatility is expected as traders respond to Friday’s liquidation and position ahead of upcoming data releases. Watch for increased volume between 9:30 a.m. and 10:30 a.m. ET, where directional intent typically confirms.

Takeaway of the Day

After a week of strong downside momentum, the Nasdaq futures market begins Monday in a state of cautious recovery. Overnight structure shows stabilization but not yet strength, with balance forming between 24,500 and 24,900. The first hour of RTH trade will reveal whether buyers can hold that base or if Friday’s pressure resumes.

Upcoming High-Impact Events

Monday, October 14 – U.S. Retail Sales Report

Tuesday, October 15 – PPI and Industrial Production

Wednesday, October 16 – Jobless Claims and Fed Commentary