NQ Flow Report

NQ Midday Flow Pulse

Market Structure Update – Monday, October 20, 2025

Morning Structure Recap

NQ opened the RTH session near 25203.25 and rotated lower before establishing a firm base. From that foundation, price expanded upward through a series of higher-highs toward 25344.00, completing a full-range directional recovery into midday. The climb developed steadily, with each pullback defended above the developing control line, confirming regained momentum alignment as the session transitioned toward ETH open.

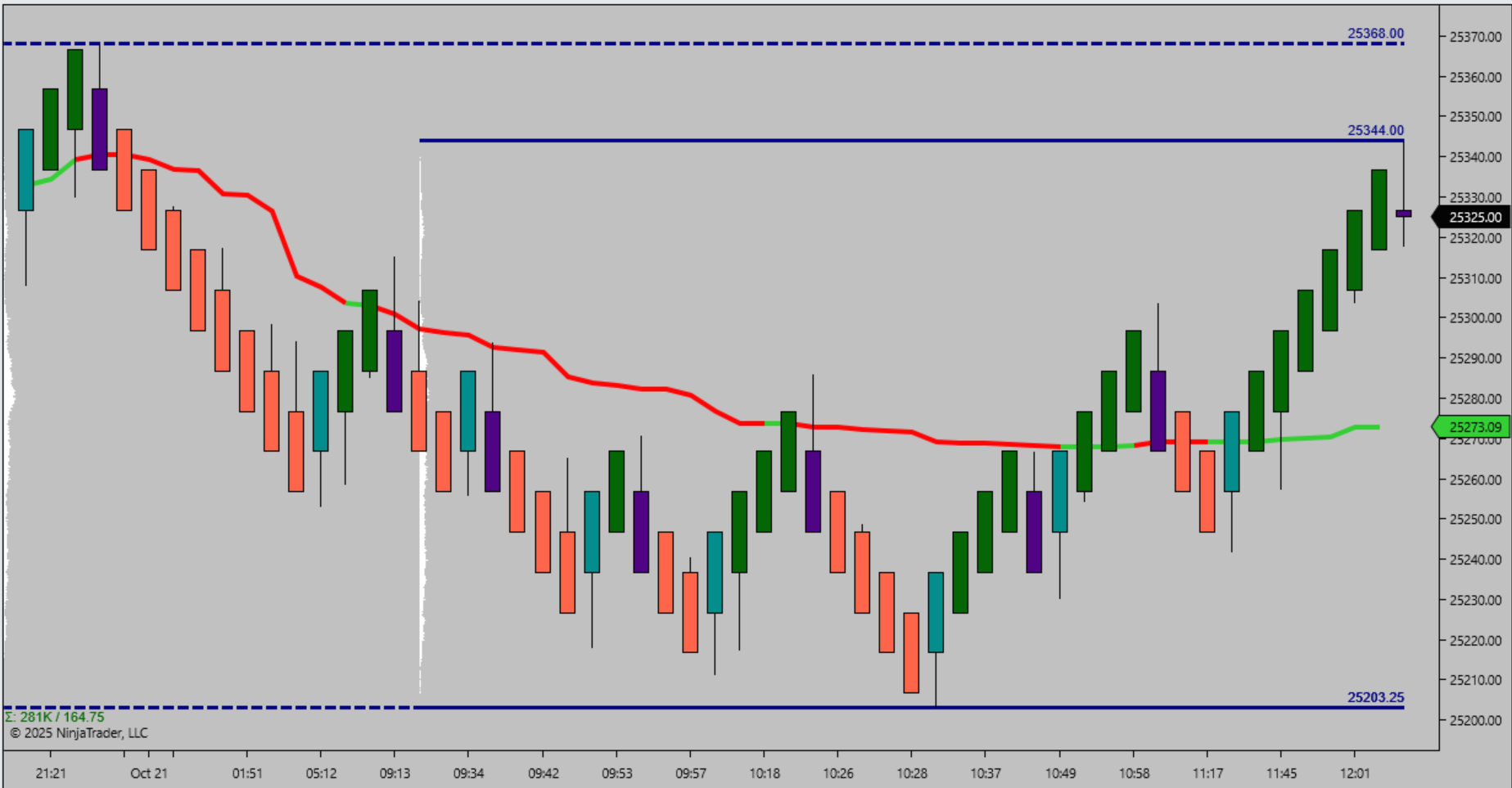

Figure 1 - Chart Midday Structure Overview (October 22, 2025)

The chart highlights a complete intraday rotation from the RTH low 25203.25 to 25344.00. Price shows clear higher-low rhythm through the late morning climb, with 25273.00 marking the structural control line and 25203.25 defining the defended base. Momentum maintained elevation into the ETH open, signaling sustained structural strength.

Current Session Rhythm

Midday rhythm shows continuation strength as price stabilizes near the ETH open above 25273.00. The defended RTH base at 25203.25 anchors the structure, while resistance remains defined at 25344.00. Momentum rhythm favors continuation while holding above the control line.

Key Intraday Levels

Support Zone – 25203.25 – 25230.00 – RTH low and structural base

Resistance Zone – 25344.00 – RTH morning high and exhaustion pivot

Trigger Level – 25273.00 – Active control line; above favors continuation

Afternoon Bias

Bias – Bullish above 25273.00

Continuation remains favored while structure holds above 25273.00. Acceptance below this level would signal a return rotation toward the base near 25203.25.

Bias Summary

Untested HTF Structure High – 25432.75

Untested HTF Structure Low – 24955.75

Validation Level – 25273.00

Continuation is favored when price holds above validation and rotation expected below.

Trader Tip

Structure expands through the same levels it first defends. Momentum confirms continuation when rhythm sustains above the breakout base.