NQ Flow Report

Flow Report – Tuesday, October 21, 2025

Yesterday’s RTH Recap

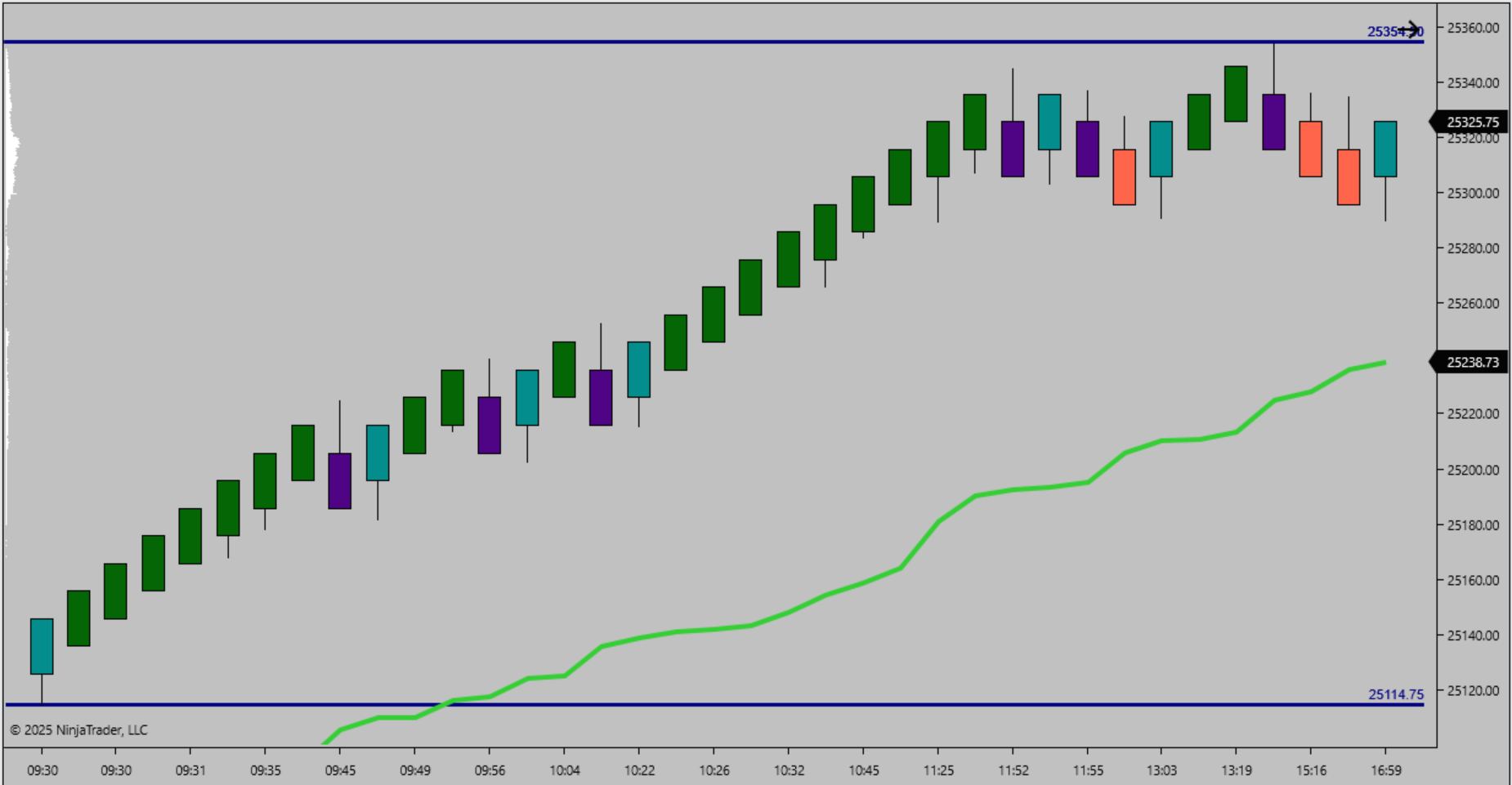

Monday’s RTH session extended the bullish sequence from 25114.75 to 25354.50. Structure advanced cleanly with higher highs and shallow pullbacks, confirming momentum continuation through the prior ETH high. Price compressed near the upper boundary into the afternoon, limiting trade entry opportunity as control remained firmly one-sided.

RTH Session October 20, 2025

Today’s ETH Framework

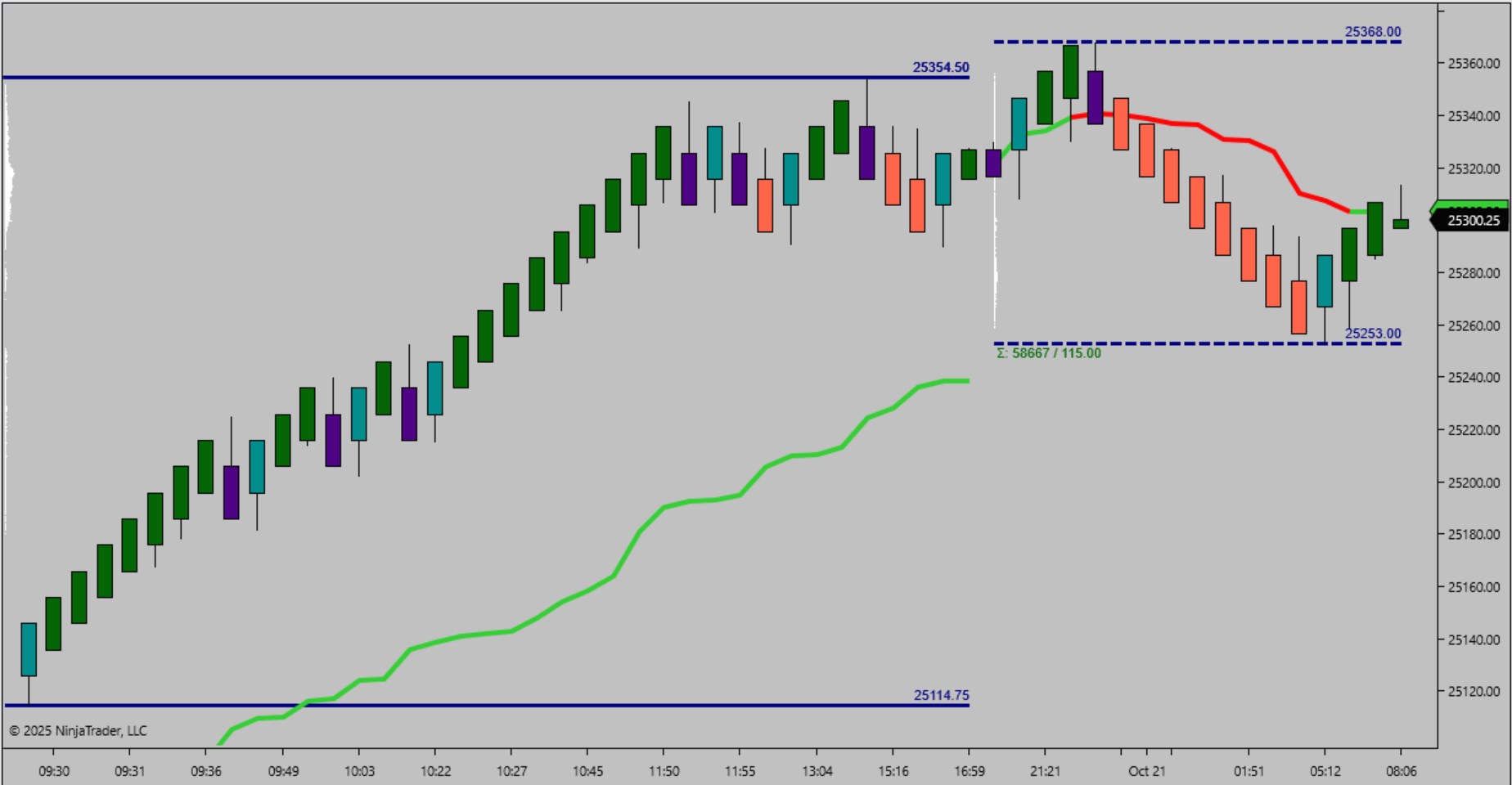

Overnight trade extended slightly beyond Monday’s high, printing 25368.00 and maintaining a narrow consolidation above 25253.00. The session shows steady balance within elevated structure, suggesting early continuation potential while holding above prior RTH support. With no scheduled economic catalysts today, price rhythm and momentum sequence will define the open.

ETH Session October 21, 2025

Bias and Structure Outlook

Bias – Bullish with validation at 25253.00.

Continuation remains favored while structure holds above 25253.00. Sustained trade above 25350.00 confirms active momentum control. A breakdown below 25250.00 could rotate price toward 25150.00 to retest lower balance.

Key Levels Table

Support Zone 25253.00 ETH base and validation level

Resistance Zone 25368.00

Overnight high and expansion marker Trigger Level 25350.00

Momentum continuation threshold

Bias Summary

Untested HTF Structure High – 25368.00

Untested HTF Structure Lows – 25045.25, 24955.75

Validation Level – 25253.00

Continuation is favored while price holds above validation; rotation expected if momentum fades below.

Trader Tip

Compression near expansion highs often limits trade opportunity but confirms sustained structural control.