NQ Flow Report

NQ Midday Flow Pulse

Market Structure Update – Monday, October 20, 2025

Morning Structure Recap

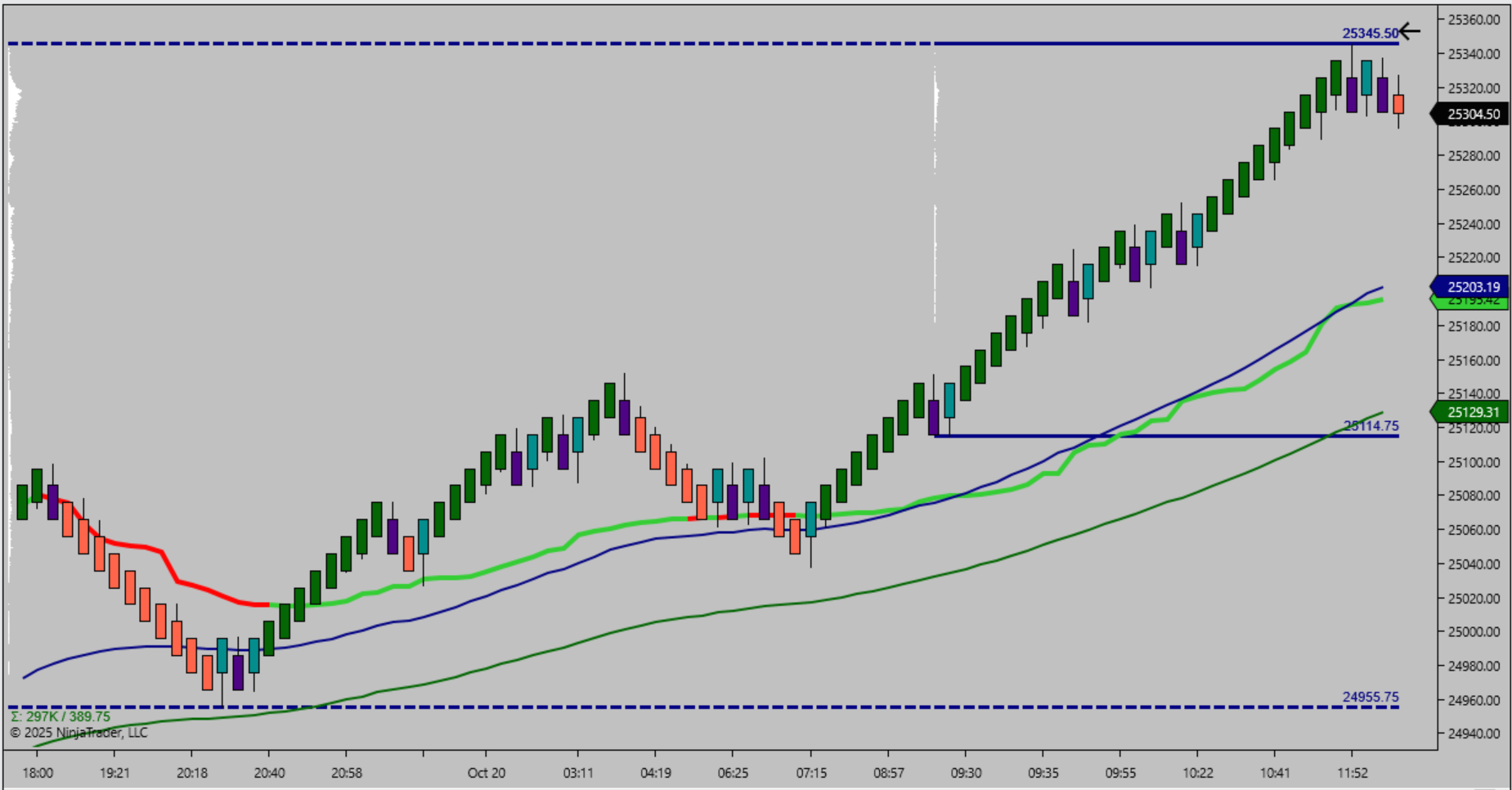

NQ extended sharply from the early ETH base near 24955.75, driving a one-sided morning expansion to 25345.50. Structure remained directional with clean higher highs and shallow pullbacks, showing firm momentum control through the morning rotation window.

Figure 1 – 80-Chart Midday Structure Overview (ETH/RTH, October 20, 2025)

Current Session Rhythm

Midday rhythm shows initial exhaustion near the 25345.50 high, with price stabilizing above 25200–25130. The prior breakout zone around 25114.75–25129.31 now defines the intraday structural base. The tone remains bullish while the session holds above this pocket.

Key Intraday Levels

TypeLevelCommentSupport Zone25114.75 – 25129.31Prior breakout and structural baseResistance Zone25345.50Morning high and exhaustion pivotTrigger Level25203.19Midday control line; above favors continuation

Afternoon Bias

Bias – Bullish while above 25203.19.

Continuation remains favored with rhythm holding above the trigger zone; acceptance below 25200 would shift tone toward rotation.

Bias Summary

Untested HTF Structure High – 25345.50

Untested HTF Structure Low – 24955.75

Validation Level – 25203.19

Continuation is favored when price holds above validation and rotation expected below.

Trader Tip

Structure expands through the same levels it first defends. Momentum often confirms when prior breakout zones hold as midday support.