NQ Flow Report

Wednesday, November 12, 2025

Yesterday’s RTH Recap

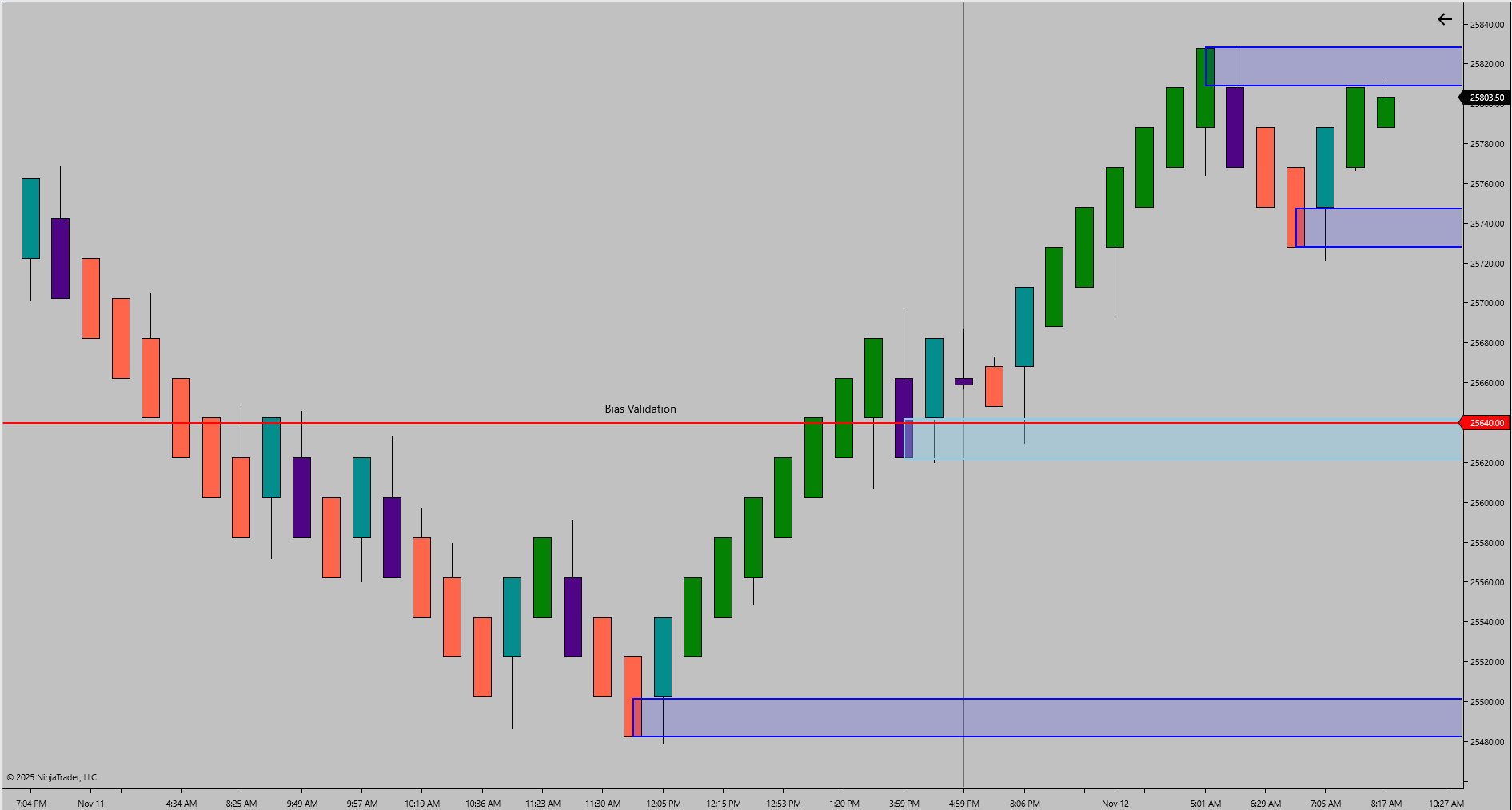

The RTH session opened near 25500 and expanded steadily to a high of 25768.75 before consolidating. Buyers regained control after defending 25478.50, reclaiming the prior structural zone and sustaining momentum through the upper resistance band. The recovery confirmed a shift back into continuation structure following Monday’s controlled pullback.

Figure 1 – RTH/ETH Structure Recap

Today’s ETH Framework

Overnight structure extended modestly higher, reaching 25830.00 before rotating down toward 25629.50. Price remains inside an upper consolidation channel, holding above the reclaimed 25600 support zone. Continuation bias remains active while structure stays elevated within this range, with resistance overhead near 25820–25840.

News and Economic Events

No high-impact U.S. economic news is scheduled for today.

Bias and Structure Outlook

Momentum context favors a bullish continuation while price remains above 25600. A clean expansion through 25840 would confirm renewed trend strength targeting 25900–25950. Below 25600, structure could rotate into a mid-session balance zone between 25500–25450 before new directional commitment appears.

Key Levels

Type: Resistance Zone

Zone Range: 25820.00 – 25840.00

Comment: ETH upper consolidation ceiling and near-term rejection area

Type: Support Zone

Zone Range: 25600.00 – 25550.00

Comment: Active structural base with repeated intraday defense

Type: Support Zone

Zone Range: 25450.00 – 25400.00

Comment: Lower liquidity shelf and prior RTH reaction base

Type: Trigger Level

Zone Range: 25840.00

Comment: Breakout validation threshold for directional continuation

Bias Summary

Bias: Bullish while above 25600

Trader Tip

When structure consolidates near prior highs, focus on reaction quality rather than price alone. A strong breakout is confirmed not by the breakout candle itself but by how efficiently pullbacks are absorbed afterward. Strength reveals itself through quick recoveries, not just fast moves.