NQ Flow Report

Tuesday, November 11, 2025

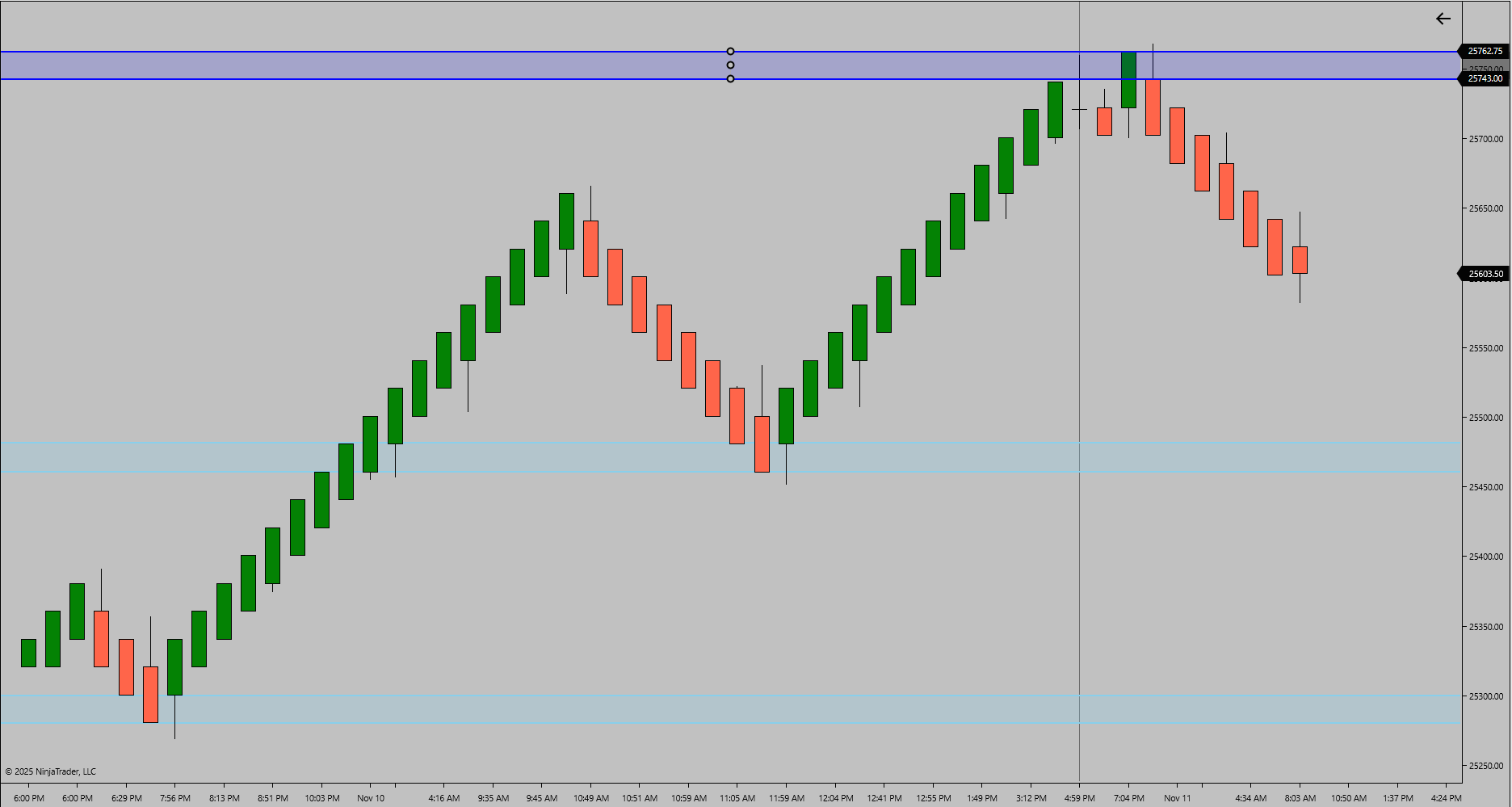

Yesterday’s RTH Recap

The RTH session formed a controlled advance from 25452.00 to 25760.50 before consolidating into the close. Buyers defended the 25500 zone early in the session and maintained upward control throughout, completing a clean extension leg after Monday’s continuation rally.

Figure 1 – RTH/ETH Structure Recap

Today’s ETH Framework

Overnight trade extended slightly above the RTH high to 25768.75 before pulling back to 25582.25. The session has shown limited volatility, consolidating just below the upper resistance band near 25750. Short-term behavior reflects pause within a broader continuation structure, as buyers attempt to defend higher lows without fresh breakout energy.

News and Economic Events

No high-impact U.S. economic news is scheduled for today.

Bias and Structure Outlook

Current structure favors a neutral-to-bullish stance while above 25550. A confirmed breakout through 25770 could reestablish continuation momentum toward 25850–25900. Failure to hold above 25550 may lead to a controlled rotation back toward 25450 or the deeper 25350 zone for support testing.

Bias Summary

Bias: Neutral-to-Bullish within consolidation

Key Levels:

• 25770 – Upper resistance trigger zone

• 25550 – Structural support

• 25450 – Lower test zone

Key Levels

Type: Resistance Zone

Zone Range: 25740.00 – 25770.00

Comment: Active upper band resistance from ETH session

Type: Support Zone

Zone Range: 25550.00 – 25580.00

Comment: Active intraday defense and structural equilibrium pocket

Type: Support Zone

Zone Range: 25450.00 – 25350.00

Comment: Deep test zone aligning with prior RTH consolidation base

Type: Trigger Level

Zone Range: 25770.00

Comment: Validation threshold for continuation breakout

Trader Tip

When momentum stalls near resistance, observe how structure reclaims control. A brief pause or small retrace can often recharge the trend. Discipline lies in waiting for validation — patience in consolidation defines strength in expansion.