NQ Flow Report

Monday, November 10, 2025

Yesterday’s RTH Recap

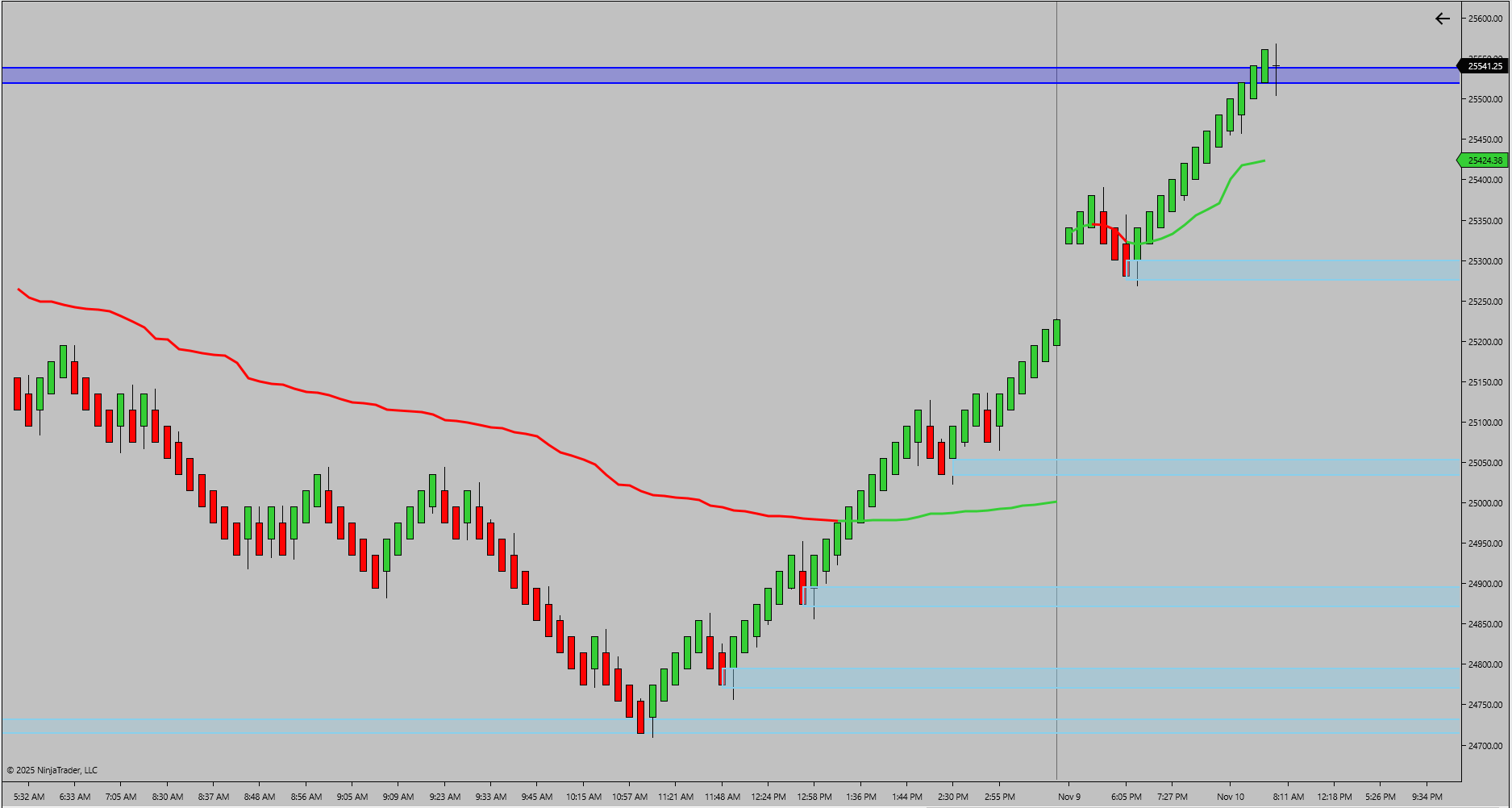

Friday’s RTH session printed a strong expansion from 24709.25 to 25354.75 after reclaiming the prior structural base. Buyers maintained control through multiple intraday rotations, leading into a decisive close near upper resistance. This renewed momentum defined a clear shift in structural rhythm heading into the new week.

Figure 1 – RTH/ETH Structure Recap

Today’s ETH Framework

Overnight ETH continued the upward sequence, extending to 25569.50 before encountering early-session resistance. The lower boundary at 25269.00 now represents active intraday support. This continuation has filled the remaining pocket from last week’s RTH range, completing a full recovery leg into prior resistance.

News and Economic Events

No high-impact economic events are scheduled for today. Market rhythm is expected to follow structural behavior without external catalysts

Bias and Structure Outlook

Bias – Bullish with Caution.

Price is currently interacting with overhead resistance near 25550–25570. Sustained acceptance above this area would confirm structural continuation and open potential for new expansion highs. A rejection, however, could trigger the first controlled pullback into the 25300–25250 range, which aligns with the short-term equilibrium zone.

Key Levels

Type: Resistance Zone

Zone Range: 25550.00 – 25570.00

Comment: Active ETH rejection cluster

Type: Support Zone

Zone Range: 25300.00 – 25250.00

Comment: Short-term equilibrium and potential re-entry base

Type: Support Zone

Zone Range: 25000.00 – 24700.00

Comment: Prior structural demand base and defended RTH low

Type: Trigger Level

Zone Range: 25570.00

Comment: Structural validation for continuation

Bias Summary

RTH High – 25354.75

RTH Low – 24709.25

ETH High – 25569.50

ETH Low – 25269.00

Current structure favors bullish continuation with a potential early pullback into support zones before directional confirmation.

Trader Tip

After strong expansion days, structural rhythm often compresses before the next directional leg. Avoid chasing new highs during early consolidation. Instead, focus on how price behaves around prior support zones—continuation strength comes from controlled pullbacks, not spikes.