NQ Flow Report

Weekly Market Structure Outlook – Nasdaq Futures (Week of November 3–7, 2025)

Structural Context Summary

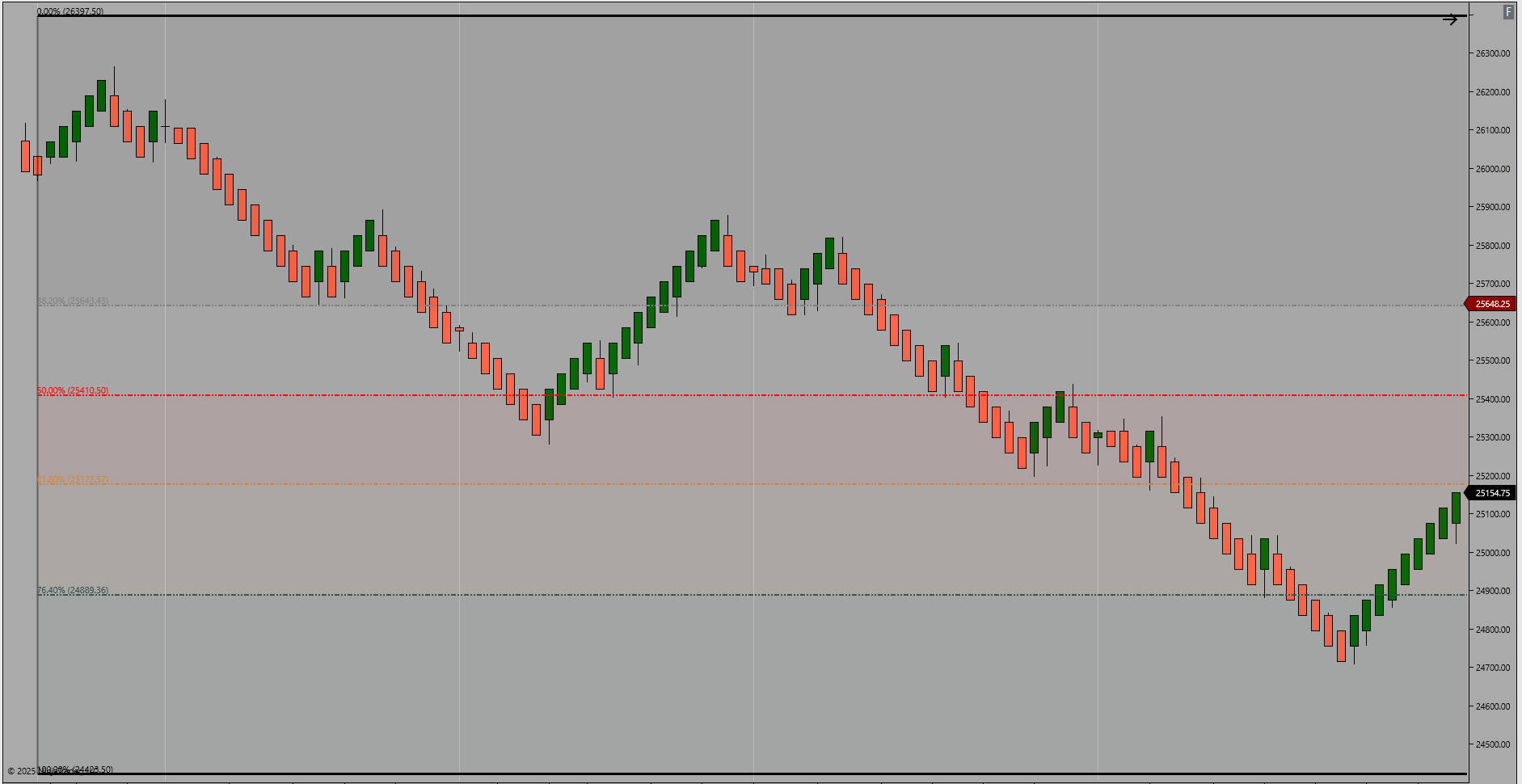

The Nasdaq futures market completed a significant corrective leg last week, retracing beyond the 78.6% of its October 17 impulse before stabilizing. Price structure has now transitioned from broad rotation into a potential base-building phase. Buyers reclaimed control late in the week from the 24709.25 low, forming the foundation for early-week balance or continuation attempts.

Friday RTH Session Review

Friday’s RTH session held higher lows through midday and closed with firm upward rhythm, defending 25050–25100 as structural support. The session ended near 25226.75, marking the first constructive higher low since the November 5 exhaustion break.

Figure 1 – Weekly Structure with Fibonacci Pullback Context

Weekly Structure Overview

The retracement from the October 17 low (24430.50) to the 26266.00 high completed a deep pullback beyond the 78.6% level before showing signs of absorption. This deeper-than-expected retracement suggests reaccumulation rather than sustained trend failure. Structure remains inside the broader expansion leg, with short-term rotation occurring within a high-time-frame control zone.

Retracement Context (Fibonacci)

The pullback extended through 61.8% (25181.00) and briefly below 78.6% (24846.00) before rebounding. The recovery into the 25200–25300 zone indicates that demand remains active near prior structural balance. Sustained acceptance above the 50% midpoint at 25414.00 would confirm renewed directional intent.

Key Structural Levels

Resistance Zone 25648.25 – 25700.00 – Upper balance cap and reaction zone

Resistance Zone 25414.00 – 25480.00 – Fibonacci midpoint and validation area

Support Zone 25200.00 – 25150.00 – Recent RTH defended structure

Support Zone 24900.00 – 24700.00 – Macro base and exhaustion low

Structural Milestones

Untested Weekly Structure High – 26266.00

Untested Weekly Structure Low – 24709.25

Validation Level – 25414.00

Continuation favored above validation; rotation expected below.

Next Week’s High Impact News

Thursday - Core Inflation Rate (08:30 ET)

Friday – Retail Sales, PPI (08:30 ET)

Bias and Outlook

Bias – Neutral-to-Bullish (Validation 25414.00)

The week begins within a high compression field. Continuation above 25414.00 opens a path toward 25650–25700. Failure below 25150.00 reintroduces rotational pressure into the 24900–24700 base.

Educational Insight / Trader Tip

When structure retraces deeper than expected yet maintains pattern integrity, it reflects energy absorption — not weakness. True reversals only confirm when reclaimed levels fail to defend.

Weekly Reflection

Strength is built through structure that survives compression. The disciplined trader recognizes deep retracements as potential reloading zones, not invalidations, when higher-frame structure remains intact.