NQ Flow Report

Thursday, November 13, 2025

Yesterday’s RTH Recap

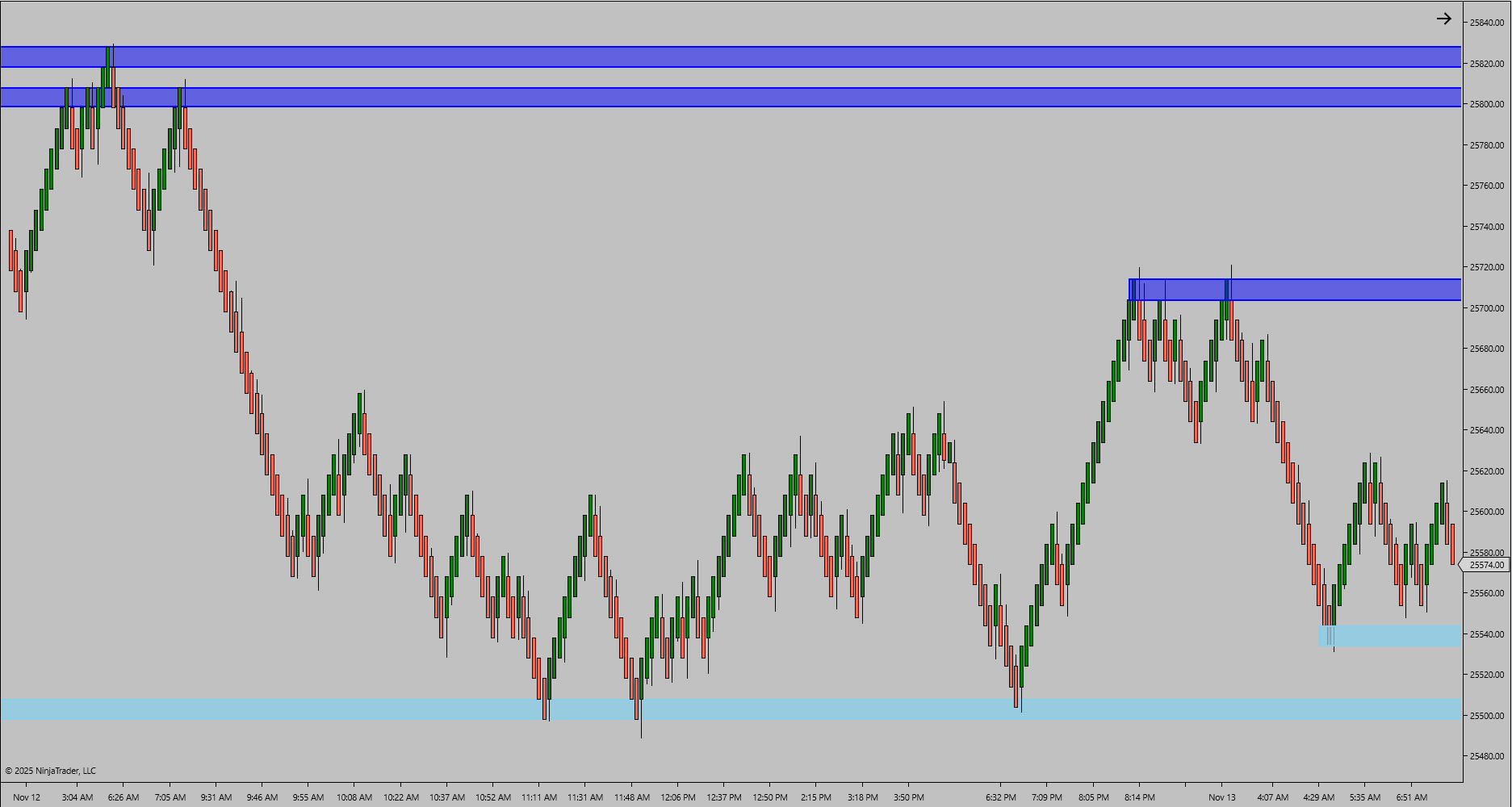

Price opened inside prior structure and held a wide rotational range through most of the session. Attempts to lift toward upper resistance failed, and sellers pushed the market back into the center of Tuesday’s structure. RTH closed inside a broad consolidation band with no directional follow-through.

Figure 1 – RTH/ETH Structure Recap

Today’s ETH Framework

ETH traded between 25721.50 and 25501.50, holding inside yesterday’s mid-range. Buyers defended the 25500 pocket, while sellers capped every rotation into 25700. Tone remains balanced with neither side establishing control.

News and Economic Events

There was no meaningful reaction to today’s high-impact release. Structure remains the primary driver.

Bias and Structure Outlook

Bias remains neutral until price accepts above 25720 or breaks back below 25500. Continuation requires a clean move through upper resistance, while failure to hold 25500 opens the door for renewed rotation lower.

Key Levels

Type: Resistance Zone

Zone Range: 25700.00 – 25730.00

Comment: Repeated ETH rejection cluster near upper band

Type: Resistance Zone

Zone Range: 25810.00 – 25830.00

Comment: RTH high and upper rejection zone

Type: Support Zone

Zone Range: 25500.00 – 25480.00

Comment: Active ETH/RTH demand pocket

Type: Support Zone

Zone Range: 25450.00 – 25390.00

Comment: Lower structural defense from Tuesday’s rotation

Type: Trigger Level

Zone Range: 25720.00

Comment: Validation level required for continuation upward

Bias Summary

Untested HTF Structure High – 25830.00

Untested HTF Structure Low – 25488.75

Validation Level – 25720.00

Session Energy Summary – Neutral

Continuation favored above validation; rotation expected below.

Trader Tip

When price compresses inside prior structure, let the market declare direction. Acceptance through resistance signals continuation, while defense at support confirms rotation.