NQ Flow Report

Thursday, November 6, 2025

Yesterday’s RTH Recap

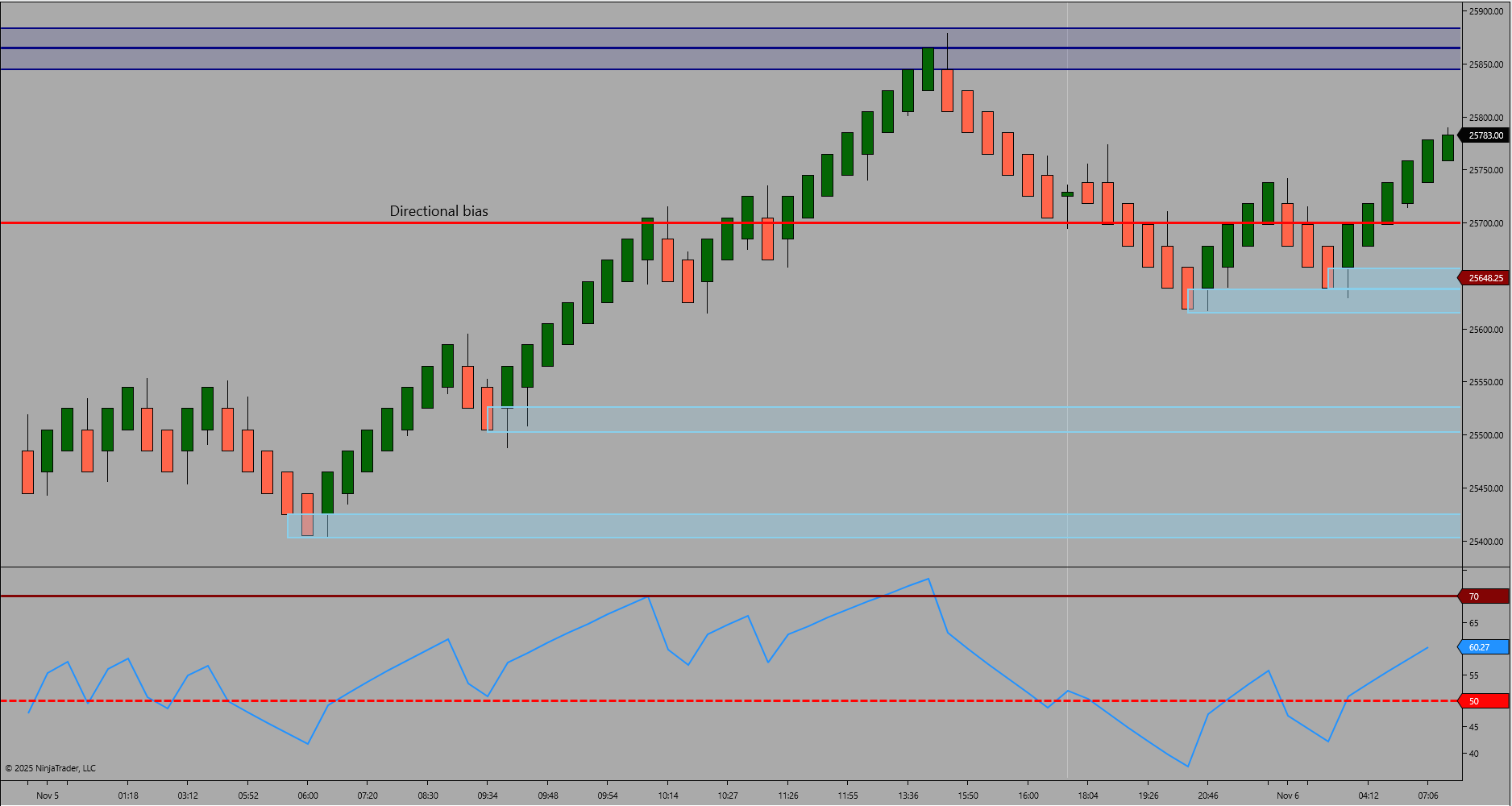

Wednesday’s RTH session traded between 25880.00 and 25617.25, continuing a slow structural climb after the prior day’s compression. Price retested the lower demand area before reclaiming control into the midrange. The session held higher lows and built a small structural base above 25650.00, confirming early signs of stabilization.

Figure 1 – RTH/ETH Structure Recap

Today’s ETH Framework

Overnight ETH trade extended within a contained structure, printing a high of 25791.00 and a low of 25404.00. The ETH range has narrowed as price consolidates near midstructure, with buyers defending the lower 25500.00 zone. The prior RTH high at 25880.00 remains the key upside reference for directional expansion if continuation strength develops.

Bias and Structure Outlook

Bias – Neutral to Bullish.

The framework supports a developing base after recent downside exhaustion. A sustained bid above 25700.00 can confirm control and open a test of 25850.00–25880.00, while failure to hold 25500.00 would signal renewed pressure back into the lower structural pocket.

Key Levels

Type: Resistance Zone

Zone Range: 25850.00 – 25880.00

Comment: RTH structural cap and current upside validation

Type: Support Zone

Zone Range: 25500.00 – 25400.00

Comment: Active ETH base with repeated defense

Type: Trigger Level

Zone Range: 25700.00

Comment: Midstructure control point for continuation or rejection

Bias Summary

Untested HTF Structure High – 25880.00

Untested HTF Structure Low – 25404.00

Validation Level – 25700.00

Continuation higher favored while above validation. Breakdown through 25500.00 reopens lower rotation.

Trader Tip

Momentum reclaims often begin quietly—watch the reaction around 25700.00 for confirmation of control transfer before chasing directional expansion.